食品添加物の世界市場:タイプ別2020年市場予測

Food Additives Market by Type (Acidulants, Colors, Emulsifiers, Flavors, Hydrocolloids, Preservatives, Sweeteners), Source (Natural, Synthetic), Application (Bakery & Confectionery, Beverages, Dairy & Frozen Desserts), & by Region - Global Forecast to 2020

- 出版元:MarketsandMarkets(米国)

出版元について

出版元について - 発行年:2015年 10月

- 定価 Single User License(1名様ライセンス)US$5,650(米国ドル)/Multi User License(5名様)$6,650 /Corporate User License $8,150

- ご予算に応じた各種ご提案も承ります。詳細はお問い合わせください。

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文 174ページになります。

- 商品コード:MAM156

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

【レポート紹介】

食品添加物の世界市場規模は2015年以後、年平均5.6%の成長が続き、2020年には522億ドル規模の市場に達することが予測されます。地域別では現在米国が最大市場となっていますが、今後の成長の速さではアジア太平洋地域、特にインドと中国において顕著な成長が見込まれます。当レポートでは、2015年から2020年に至る食品・飲料添加物の世界市予測、添加物種類別市場(着色料、香料、甘味料、保存料、乳化剤、酸味料等)、原料別市場(自然、合成、植物、動物、微生物)、用途食品別市場(パン製菓、飲料、インスタント食品、乳製品と冷菓、ソーススパイス・調味料等)、主要国地域別市場などの詳細予測データと分析を掲載しています。また競合分析、当局規制、リーディング企業動向などの調査情報を盛り込み、今後展望と市場機会を検証していきます。

【レポート構成概要】

◆食品添加物の世界市場予測2015-2020年

◆セグメント別市場予測2015-20年および分析

<添加物タイプ別市場>

・酸味料

・凝固防止剤

・着色料

・乳化剤

・酵素

・香料

・ハイドロコロイド

・保存料

・甘味料

<タイプ別・原料別市場>

・着色料

- 自然原料

- 合成原料

・乳化剤

- 動物由来

- 植物由来

・酵素

- 微生物由来

- 植物由来

- 動物由来

・香料

- 自然原料

- 合成原料

・ハイドロコロイド

- 自然原料

- 合成原料

・保存料

- 自然原料

- 合成原料

<用途食品別市場>

・パン&製菓

・飲料

・インスタント食品97

・乳製品&冷菓

・ソース、ドレッシング、スパイス、調味料

・その他食品

<主要国地域別市場>

・北米

・欧州

・アジア太平洋

・その他地域

(※主要国別データあり)

◆競合分析、市場展望

・ファイブフォース分析(競合分析モデル)

・当局規制

・新製品

・市場の促進要因と阻害要因、市場機会

◆リーディング企業動向と分析

・BASF SE

・ARCHER DANIELS MIDLAND COMPANY

・E.I. DUPONT

・KERRY GROUP

・INGREDION INCORPORATED

・TATE & LYLE PLC

・CHR. HANSEN HOLDING A/S

・EVONIK INDUSTRIES AG

・NOVOZYMES A/S

【レポート詳細目次、データ項目一覧は当ページ下を参照ください】

英文詳細目次(table of contents)

【原文詳細目次】

Food Additives Market by Type (Acidulants, Colors, Emulsifiers, Flavors, Hydrocolloids, Preservatives, Sweeteners), Source (Natural, Synthetic), Application (Bakery & Confectionery, Beverages, Dairy & Frozen Desserts), & by Region - Global Forecast to 2020

Table of Contents

1 INTRODUCTION 15

1.1 OBJECTIVES OF THE STUDY 15

1.2 MARKET DEFINITION 15

1.3 MARKET SCOPE 16

1.3.1 MARKETS COVERED 16

1.3.2 YEARS CONSIDERED FOR THE STUDY 17

1.4 CURRENCY 17

1.5 STAKEHOLDERS 17

1.6 LIMITATIONS 18

2 RESEARCH METHODOLOGY 19

2.1 RESEARCH DATA 19

2.1.1 SECONDARY DATA 20

2.1.1.1 Key data from secondary sources 20

2.1.2 PRIMARY DATA 20

2.1.2.1 Key data from primary sources 21

2.1.2.2 Key industry insights 22

2.1.2.3 Breakdown of primaries 22

2.2 FACTOR ANALYSIS 23

2.2.1 INTRODUCTION 23

2.2.2 DEMAND-SIDE ANALYSIS 23

2.2.2.1 Rising population 23

2.2.2.1.1 Increase in middle-class population, 2009–2030 24

2.2.2.2 Developing economies, gdp (purchasing power parity), 2013 25

2.2.2.3 Increasing meat consumption 25

2.2.2.4 Preference for natural additives 25

2.2.2.5 Growth in the global beverage and dairy industry 26

2.2.2.6 Rising demand for bakery products 27

2.2.3 SUPPLY-SIDE ANALYSIS 27

2.2.3.1 Research & development initiatives 28

2.2.3.2 Natural vs. Synthetic food additives 28

2.3 MARKET SIZE ESTIMATION 29

2.4 MARKET BREAKDOWN & DATA TRIANGULATION 31

2.5 RESEARCH ASSUMPTIONS 32

2.5.1 ASSUMPTIONS 32

3 EXECUTIVE SUMMARY 33

4 PREMIUM INSIGHTS 37

4.1 OPPORTUNITIES IN THE FOOD ADDITIVES MARKET 37

4.2 KEY FOOD ADDITIVES MARKETS, 2015 37

4.3 LIFE CYCLE ANALYSIS: FOOD ADDITIVES MARKET, BY REGION 38

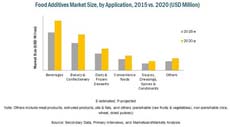

4.4 FOOD ADDITIVES MARKET, BY TYPE, 2015 VS. 2020 39

4.5 ASIA-PACIFIC ESTIMATED TO BE THE FASTEST GROWING MARKET FOR FOOD ADDITIVES, 2015–2020 40

4.6 DEVELOPED VS. EMERGING FOOD ADDITIVES MARKETS, 2015 VS. 2020 40

4.7 FOOD ADDITIVES MARKET, TYPE BY REGION, 2015 41

4.8 FOOD ADDITIVES MARKET, APPLICATION BY REGION, 2014 41

5 MARKET OVERVIEW 42

5.1 INTRODUCTION 42

5.2 FOOD ADDITIVES MARKET SEGMENTATION 43

5.2.1 FOOD ADDITIVES MARKET, BY TYPE 43

5.2.2 FOOD ADDITIVES MARKET, BY APPLICATION 43

5.2.3 FOOD ADDITIVES MARKET, BY SOURCE 44

5.3 MARKET DYNAMICS 44

5.3.1 DRIVERS 44

5.3.1.1 Increasing demand for food products with extended shelf life 44

5.3.1.2 Growing demand for convenience foods 45

5.3.1.3 Rising consumption of premium food & beverage products 45

5.3.1.4 Research & development driving innovation 46

5.3.1.5 Multi-functionality of food additives 46

5.3.2 RESTRAINTS 46

5.3.2.1 Increasing demand for organic foods 46

5.3.2.2 Limited sources and high costs of natural additives 47

5.3.2.3 Health effects of synthetic additives 47

5.3.3 OPPORTUNITIES 47

5.3.3.1 Emerging markets in asia-pacific & africa along with changing lifestyles 47

5.3.3.2 Functionality of natural additives 48

5.3.3.3 Large number of emerging applications 48

5.3.3.4 Emerging markets and changing consumer lifestyles 49

5.3.4 CHALLENGES 49

5.3.4.1 Fluctuating prices of raw materials leading to uncertainty in the market 49

5.3.4.2 Unclear labeling creating confusion among consumers 49

6 INDUSTRY TRENDS 50

6.1 INTRODUCTION 50

6.2 VALUE CHAIN ANALYSIS 50

6.3 FACTORS AFFECTING THE CHOICE OF FOOD ADDITIVES 51

6.3.1 REGULATIONS AFFECTING THE FOOD ADDITIVES MARKET 51

6.3.1.1 Food preservatives 51

6.3.1.2 Flavors 51

6.3.1.3 Colors 52

6.3.1.4 Food emulsifiers 52

6.3.1.5 Food enzymes 52

6.3.1.6 Anti-caking 53

6.3.1.7 Sweeteners 53

6.3.1.8 Acidulants 53

6.3.2 PERMISSIBLE LIMITS 53

6.3.2.1 Preservatives 53

6.3.2.2 Anti-caking 53

6.3.2.2.1 Fda regulations 53

6.3.2.2.2 European regulations 54

6.3.2.3 Sweeteners 54

6.3.2.4 Colors 54

6.3.3 PREFERENCE TO NATURAL ADDITVES 54

6.3.4 SUPPLY OF ADDITIVES 54

6.4 PORTER’S FIVE FORCES ANALYSIS 55

6.4.1 THREAT OF NEW ENTRANTS 55

6.4.2 THREAT OF SUBSTITUTES 56

6.4.3 BARGAINING POWER OF SUPPLIERS 57

6.4.4 BARGAINING POWER OF BUYERS 58

6.4.5 INTENSITY OF COMPETITIVE RIVALRY 58

7 FOOD ADDITIVES MARKET, BY TYPE 60

7.1 INTRODUCTION 61

7.2 ACIDULANTS 62

7.3 ANTI-CAKING AGENTS 65

7.4 COLORS 67

7.5 EMULSIFIERS 70

7.6 ENZYMES 73

7.7 FLAVORS 75

7.8 HYDROCOLLOIDS 78

7.9 PRESERVATIVES MARKETS 80

7.10 SWEETENERS 83

8 FOOD ADDITIVES MARKET, BY SOURCE 86

8.1 INTRODUCTION 87

8.1.1 COLORS 87

8.1.1.1 Natural source 87

8.1.1.2 Synthetic source 88

8.1.1.3 Nature identical colors 88

8.1.2 EMUSLIFIERS 88

8.1.2.1 Animal source 88

8.1.2.2 Plant source 89

8.1.3 ENZYMES 89

8.1.3.1 Microorganism source 89

8.1.3.2 Plant source 89

8.1.3.3 Animal source 90

8.1.4 FLAVORS 90

8.1.4.1 Natural source 90

8.1.4.2 Synthetic source 90

8.1.5 HYDROCOLLOIDS 91

8.1.5.1 Natural source 91

8.1.5.2 Synthetic source 91

8.1.6 PRESERVATIVES 92

8.1.6.1 Natural source 92

8.1.6.2 Synthetic source 92

9 FOOD ADDITIVES MARKET, BY APPLICATION 94

9.1 INTRODUCTION 95

9.1.1 BAKERY & CONFECTIONERY 96

9.1.2 BEVERAGES 97

9.1.3 CONVENIENCE FOOD 97

9.1.4 DAIRY & FROZEN DESSERTS 98

9.1.5 SAUCES, DRESSINGS, SPICES & CONDIMENTS 100

9.1.6 OTHER APPLICATIONS 101

10 FOOD ADDITIVES MARKET, BY REGION 102

10.1 INTRODUCTION 103

10.2 NORTH AMERICA 104

10.3 EUROPE 107

10.4 ASIA-PACIFIC 110

10.5 REST OF WORLD 113

11 COMPETITIVE LANDSCAPE 116

11.1 OVERVIEW 116

11.2 FOOD ADDITIVES MARKET SHARE ANALYSIS 117

11.3 COMPETITIVE SITUATION & TRENDS 118

11.3.1 NEW PRODUCT LAUNCH & APPROVAL 119

11.3.2 EXPANSIONS & INVESTMENTS 122

11.3.3 ACQUISITIONS & STRATEGIC ALLIANCES 126

11.3.4 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & JOINT VENTURES 127

12 COMPANY PROFILES 130

12.1 INTRODUCTION 130

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.2 CARGILL INC. 131

12.3 BASF SE 135

12.4 ARCHER DANIELS MIDLAND COMPANY 138

12.5 E.I. DUPONT 142

12.6 KERRY GROUP 148

12.7 INGREDION INCORPORATED 151

12.8 TATE & LYLE PLC 155

12.9 CHR. HANSEN HOLDING A/S 158

12.10 EVONIK INDUSTRIES AG 163

12.11 NOVOZYMES A/S 165

*Details on overview, financials, product & services, strategy, and developments might not be captured in case of unlisted companies.

13 APPENDIX 168

13.1 DISCUSSION GUIDE 168

13.2 COMPANY DEVELOPMENTS 171

13.2.1 ACQUISITIONS & STRATEGIC ALLIANCE 171

13.2.2 AGREEMENTS, PARTNERSHIPS, COLLABORATION & JOINT VENTURES 172

13.3 INTRODUCING RT: REAL TIME MARKET INTELLIGENCE 173

13.4 AVAILABLE CUSTOMIZATIONS 173

13.5 RELATED REPORTS 174

LIST OF TABLES

TABLE 1 GROWING MIDDLE-CLASS POPULATION IN ASIA-PACIFIC 24

TABLE 2 MEAT CONSUMPTION, BY TYPE, 2012–2020 (THOUSAND TONS) 25

TABLE 3 TOP FIVE GDP PER CAPITA (PPP) FOR EMERGING ECONOMIES

IN ASIA-PACIFIC, 2013 48

TABLE 4 GLOBAL FOOD ADDITIVES MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION) 62

TABLE 5 ACIDULANTS: E-NUMBERS, FUNCTIONALITIES & APPLICATIONS 62

TABLE 6 ACIDULANTS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 63

TABLE 7 ACIDULANTS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 64

TABLE 8 ACIDULANTS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 64

TABLE 9 ACIDULANTS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 64

TABLE 10 ACIDULANTS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 65

TABLE 11 ANTI-CAKING AGENTS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 65

TABLE 12 ANTI-CAKING AGENTS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE,

BY COUNTRY, 2013–2020 (USD MILLION) 66

TABLE 13 ANTI-CAKING AGENTS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013 – 2020 (USD MILLION) 66

TABLE 14 ANTI-CAKING AGENTS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013 – 2020 (USD MILLION) 67

TABLE 15 ANTI-CAKING AGENTS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 67

TABLE 16 COLORS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 68

TABLE 17 COLORS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 68

TABLE 18 COLORS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 69

TABLE 19 COLORS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 69

TABLE 20 COLORS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 70

TABLE 21 EMULSIFIERS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 71

TABLE 22 EMULSIFIERS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 71

TABLE 23 EMULSIFIERS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 71

TABLE 24 EMULSIFIERS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 72

TABLE 25 EMULSIFIERS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 72

TABLE 26 ENZYMES: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 73

TABLE 27 ENZYMES: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 73

TABLE 28 ENZYMES: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 74

TABLE 29 ENZYMES: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 74

TABLE 30 ENZYMES: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 74

TABLE 31 FLAVORS: FOOD ADDITIVES MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 75

TABLE 32 FLAVORS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 76

TABLE 33 FLAVORS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 76

TABLE 34 FLAVORS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 77

TABLE 35 FLAVORS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 77

TABLE 36 HYDROCOLLOIDS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 78

TABLE 37 HYDROCOLLOIDS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE,

BY COUNTRY, 2013–2020 (USD MILLION) 78

TABLE 38 HYDROCOLLOIDS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 79

TABLE 39 HYDROCOLLOIDS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 80

TABLE 40 HYDROCOLLOIDS: ROW FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 80

TABLE 41 PRESERVATIVES: FOOD ADDITVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 81

TABLE 42 PRESERVATIVES: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 81

TABLE 43 PRESERVATIVES: EUROPE FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 81

TABLE 44 PRESERVATIVES: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 82

TABLE 45 PRESERVATIVES: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 82

TABLE 46 SWEETENERS: FOOD ADDITVES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 83

TABLE 47 SWEETENERS: NORTH AMERICAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY, 2013–2020 (USD MILLION) 83

TABLE 48 SWEETENERS: EUROPEAN FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 84

TABLE 49 SWEETENERS: ASIA-PACIFIC FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013 – 2020 (USD MILLION) 84

TABLE 50 SWEETENERS: ROW FOOD ADDITIVES MARKET SIZE, BY REGION,

2013 – 2020 (USD MILLION) 85

TABLE 51 COLORS: FOOD ADDITIVES MARKET SIZE, BY SOURCE, 2013–2020 (USD MILLION) 88

TABLE 52 EMULSIFIERS: FOOD ADDITIVES MARKET SIZE, BY SOURCE,

2013–2020 (USD MILLION) 89

TABLE 53 ENZYMES: FOOD ADDITIVES MARKET SIZE, BY SOURCE,

2013–2020 (USD MILLION) 90

TABLE 54 FLAVORS: FOOD ADDITIVES MARKET SIZE, BY SOURCE,

2013–2020 (USD MILLION) 91

TABLE 55 HYDROCOLLOIDS: FOOD ADDITIVES MARKET SIZE, BY SOURCE,

2013–2020 (USD MILLION) 92

TABLE 56 PRESERVATIVES: FOOD ADDITIVES MARKET SIZE, BY SOURCE,

2013–2020 (USD MILLION) 93

TABLE 57 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION) 96

TABLE 58 FOOD ADDITIVES IN BAKERY & CONFECTIONERY MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 96

TABLE 59 FOOD ADDITIVES IN BEVERAGES MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 97

TABLE 60 FOOD ADDITIVES IN CONVENIENCE FOODS MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 98

TABLE 61 FOOD ADDITIVES IN DAIRY & FROZEN PRODUCTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 100

TABLE 62 FOOD ADDITIVES IN SAUCES, DRESSINGS, SPICES & CONDIMENTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 100

TABLE 63 FOOD ADDITIVES IN OTHER APPLICATIONS MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 101

TABLE 64 FOOD ADDIVTIVES MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 103

TABLE 65 NORTH AMERICA: FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 105

TABLE 66 NORTH AMERICA: FOOD ADDITIVES MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 106

TABLE 67 NORTH AMERICA: FOOD ADDITIVES MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 106

TABLE 68 EUROPE: FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 108

TABLE 69 EUROPE: FOOD ADDITIVES MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION) 109

TABLE 70 EUROPE: FOOD ADDITIVES MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 109

TABLE 71 ASIA-PACIFIC: FOOD ADDITIVES MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 111

TABLE 72 ASIA-PACIFIC: FOOD ADDITIVES MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 112

TABLE 73 ASIA-PACIFIC: FOOD ADDITIVES MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 112

TABLE 74 ROW: FOOD ADDITIVES MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 114

TABLE 75 ROW: FOOD ADDITIVES MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION) 114

TABLE 76 ROW: FOOD ADDITIVES MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 115

TABLE 77 NEW PRODUCT LAUNCH & APPROVAL, 2010–2015 119

TABLE 78 EXPANSIONS & INVESTMENTS, 2010–2015 122

TABLE 79 ACQUISITIONS & STRATEGIC ALLIANCES, 2010–2015 126

TABLE 80 AGREEMENTS, PARTNERSHIPS, JOINT VENTURES & COLLABORATIONS,

2010–2015 128

TABLE 81 NEW PRODUCT LAUNCHES, AND APPROVAL, 2010–2015 171

TABLE 82 ACQUISITIONS & STRATEGIC ALLIANCE, 2010–2015 171

TABLE 83 AGREEMENTS, PARTNERSHIPS, COLLABORATION & JOINT VENTURES, 2010–2015 172

LIST OF FIGURES

FIGURE 1 FOOD ADDITIVES MARKET SNAPSHOT 16

FIGURE 2 FOOD ADDITIVES MARKET, BY REGION 16

FIGURE 3 FOOD ADDITIVES: RESEARCH DESIGN 19

FIGURE 4 GLOBAL POPULATION IS PROJECTED TO REACH ~9.5 BILLION BY 2050 24

FIGURE 5 GROWTH RATE OF GLOBAL BEVERAGE SALES, 2011-2016 26

FIGURE 6 ANNUAL PER CAPITA CONSUMPTION OF DAIRY PRODUCTS AND FLAVORED MILK & DRINKS IN U.S., BY VOLUME (POUNDS), 2011-2016 26

FIGURE 7 BAKERY PRODUCTS MARKET SIZE, 2010-2015 (USD BILLION) 27

FIGURE 8 PRESERVATIVES MARKET SHARE, BY SOURCE, 2014 28

FIGURE 9 HYDROCOLLOIDS MARKET SHARE, BY SOURCE, 2014 29

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 30

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH 30

FIGURE 12 DATA TRIANGULATION METHODOLOGY 31

FIGURE 13 FOOD ADDITIVES MARKET SNAPSHOT, BY TYPE, 2015 VS. 2020 (USD BILLION) 34

FIGURE 14 FOOD ADDITIVES MARKET SIZE, BY REGION, 2015–2020 (USD BILLION) 34

FIGURE 15 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2015–2020 (USD BILLION) 35

FIGURE 16 FOOD ADDITIVES MARKET SHARE (VALUE), BY REGION, 2014 36

FIGURE 17 FAVORABLE FUNCTIONALITIES & LACK OF CLOSE SUBSTITUTES DRIVE THE FOOD ADDITIVES MARKET 37

FIGURE 18 THE U.S. IS ESTIMATED TO BE THE LARGEST FOOD ADDITIVES MARKET IN 2015 37

FIGURE 19 ASIA-PACIFIC POISED FOR ROBUST GROWTH, 2015 TO 2020 38

FIGURE 20 THE MARKET FOR ACIDULANTS IS PROJECTED TO RECORD HIGHEST GROWTH BETWEEN 2015 & 2020 39

FIGURE 21 THE FLAVORS SEGMENT IS ESTIMATED TO DOMINATE THE ASIA-PACIFIC MARKET FOR FOOD ADDITIVES, 2015 40

FIGURE 22 CHINA & INDIA ARE PROJECTED TO BE THE MOST ATTRACTIVE MARKETS FOR FOOD ADDITIVES DURING THE FORECAST PERIOD 40

FIGURE 23 CONSUMPTION OF FOOD ADDITIVES VARY IN ACCORDANCE WITH REGIONAL TRENDS 41

FIGURE 24 THE MARKET FOR FOOD ADDITIVES WAS THE LARGEST IN THE BEVERAGES SEGMENT, 2014 41

FIGURE 25 FOOD PRESERVATIVES MARKET, BY TYPE 43

FIGURE 26 FOOD PRESERVATIVES MARKET, BY APPLICATION 43

FIGURE 27 FOOD ADDITIVES MARKET, BY SOURCE 44

FIGURE 28 VALUE CHAIN: FOOD ADDITIVES MARKET 51

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS 55

FIGURE 30 FOOD ADDITIVES MARKET SIZE, BY TYPE, 2014: A SNAPSHOT 61

FIGURE 31 FOOD ADDITIVES MARKET SIZE, BY TYPE, 2015 VS. 2020 (USD MILLION) 61

FIGURE 32 ACIDULANTS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2015 VS. 2020 (USD MILLION) 63

FIGURE 33 EMULSIFIERS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2015 VS. 2020 (USD MILLION) 70

FIGURE 34 FLAVORS: FOOD ADDITIVES MARKET SIZE, BY REGION,

2015 VS. 2020 (USD MILLION) 75

FIGURE 35 HYDROCOLLOIDS: FOOD ADDITIVES MARKET SIZE, IN EUROPE,

2015 VS. 2020 (USD MILLION) 79

FIGURE 36 FOOD ADDIVTIVES MARKET, BY SOURCE 87

FIGURE 37 FOOD ADDITIVES MARKET SIZE, BY APPLICATION, 2014 (USD MILLION) 95

FIGURE 38 FOOD ADDITIVES IN CONVENIENCE FOODS MARKET SIZE, BY REGION,

2015 VS. 2020 (USD MILLION) 98

FIGURE 39 FOOD ADDITIVES IN DAIRY & FROZEN DESSERTS MARKET SIZE, BY REGION,

2015 VS. 2020 (USD MILLION) 99

FIGURE 40 FOOD ADDITIVES IN OTHER APPLICATIONS MARKET SIZE, BY REGION, 2014 101

FIGURE 41 GEOGRAPHIC SNAPSHOT: NEW HOTSPOTS EMERGING IN ASIA-PACIFIC 104

FIGURE 42 NORTH AMERICA: FOOD ADDITIVES MARKET 105

FIGURE 43 EUROPE: FOOD ADDITIVES MARKET 108

FIGURE 44 ASIA-PACIFIC: FOOD ADDITIVES MARKET 111

FIGURE 45 ROW: FOOD ADDITIVES MARKET 113

FIGURE 46 NEW PRODUCT LAUNCH & APPROVAL WAS PREFERRED BY KEY FOOD ADDITIVES COMPANIES, 2010–2015 116

FIGURE 47 FOOD ADDITIVES MARKET SHARE (DEVELOPMENTS), BY KEY PLAYER, 2014 117

FIGURE 48 STRENGTHENING MARKET PRESENCE THROUGH NEW PRODUCT LAUNCH, EXPANSIONS & INVESTMENTS BETWEEN 2014 & 2015 118

FIGURE 49 NEW PRODUCT LAUNCH & APPROVAL: THE KEY STRATEGY, 2014 118

FIGURE 50 GEOGRAPHICAL REVENUE MIX OF TOP FIVE PLAYERS 130

FIGURE 51 CARGILL INC.: COMPANY SNAPSHOT 131

FIGURE 52 CARGILL INC.: SWOT ANALYSIS 134

FIGURE 53 BASF SE: COMPANY SNAPSHOT 135

FIGURE 54 BASF SE: SWOT ANALYSIS 137

FIGURE 55 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT 138

FIGURE 56 ARCHER DANIELS MIDLAND COMPANY: SWOT ANALYSIS 141

FIGURE 57 DUPONT: COMPANY SNAPSHOT 142

FIGURE 58 DUPONT: SWOT ANALYSIS 147

FIGURE 59 KERRY GROUP: COMPANY SNAPSHOT 148

FIGURE 60 KERRY GROUP: SWOT ANALYSIS 150

FIGURE 61 INGREDION INCORPORATED: COMPANY SNAPSHOT 151

FIGURE 62 INGREDION INCORPORATED: SWOT ANALYSIS 153

FIGURE 63 TATE & LYLE PLC: COMPANY SNAPSHOT 155

FIGURE 64 TATE LYLE PLC: SWOT ANALYSIS 157

FIGURE 65 CHR. HANSEN HOLDINGS A/S: COMPANY SNAPSHOT 158

FIGURE 66 CHR. HANSEN HOLDING A/S: SWOT ANALYSIS 162

FIGURE 67 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT 163

FIGURE 68 NOVOZYMES A/S: COMPANY SNAPSHOT 165

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

低カロリー甘味料の世界市場2015-2025年

低カロリー甘味料の世界市場2015-2025年

お問合わせはこちらから

お問合わせはこちらから