車載HUD(ヘッドアップディスプレイ)の世界市場:2019年市場予測と動向分析

Automotive Head-up Display (HUD) Market by HUD type (Windshield & Combiner), Application (Premium & Luxury Cars) and Geography (Asia-Oceania, Europe, North America & RoW) - Industry Trends and Forecast to 2019

- 出版元:MarketsandMarkets(米国)

- 発行年:2014年12月

- 定価 Single User License(1名様ライセンス)US$5,650(米国ドル)/Multi User License(5名様)$6,650 /Corporate User License $8,150

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文になります。

- 商品コード:MAM021

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

※当レポートは更新版が発行されております。更新版の詳細は以下リンクよりご参照ください。

車載HUD(ヘッドアップディスプレイ)の世界市場:2021年市場予測と業界動向

車載HUD(ヘッドアップディスプレイ)の世界市場:2021年市場予測と業界動向

【レポート紹介】

1988年、GMによって最初の車載HUDが導入されましたが、当時はまだスピードメーターとタコメーターといった基本的な表示のみのものでした。現在のHUDは高度化しており車線情報、ナビゲーション、車間距離や障害物距離、テキストメッセージの表示などが可能となっています。アウディ、BMW、レクサス、キャデラックが米国でのHUD売上の大半を占めており、ベンツはCクラス、Sクラスの2015年モデル向けにHUDを提供する見込みです。自動車メーカーはインフォティンメントディスプレイの高度化を進めており、ベンダー企業にとっては大きな市場機会があると言えそうです。

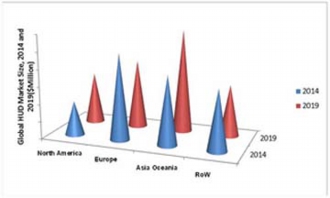

当レポートでは、高級車向けの車載HUD(ヘッド・アップ・ディスプレイ)の世界市場は2014年に1億4620万ドルに達し、今後、年平均成長率にして11.52%の拡大を続け2019年には2億5260万ドル規模に達すると予測しています。高級車市場の世界的ブームは継続することが見込まれ、購買層である超富裕層の個人は年3%から5%で増加を続けています。車載HUDシステムは通常オプション装備品として販売されますが、高価格であることが採択の主要障壁となっています。規模の経済によるコストダウンには、HUDが中間セグメント車種向けに生産、搭載されていくことが必要となるでしょう。

当レポートでは、車載HUDの世界市場を詳細に調査分析、各種セグメントでの2019年に至る市場規模予測、動向分析、主要企業情報などを概略以下の構成でお届けいたします。

<セグメント別市場予測~2019年:金額規模と出荷数を掲載>

※タイプ別 レポート抜粋

レポート抜粋

・フロントガラスHUD

・コンバイナーHUD

※地域、国別

・アジア-オセアニア

- 中国

- 日本

- 韓国

- インド

・欧州

- ドイツ

- フランス

- 英国

・北米

- 米国

- カナダ

-

・その他地域(Rest of the World)

- ロシア

- 南アフリカ

※車種別

・プレミアムカー

・ラグジュアリーカー

<主要企業情報>

Nippon Seiki Co., Ltd.

Continental AG

Denso Corporation

Robert Bosch Gmbh

Visteon Corporation

Microvision, Inc.

Delphi Automotive PLC

Johnson Controls, Inc.

BMW AG

General Motors Company

【レポート詳細目次、データ項目一覧(List of Tables)は当ページ下を参照ください】

英文詳細目次(table of contents)

【原文詳細目次】

Automotive Head-up Display (HUD) Market by HUD type (Windshield & Combiner), Application (Premium & Luxury Cars) and Geography (Asia-Oceania, Europe, North America & RoW) - Industry Trends and Forecast to 2019

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives

1.2 Market Scope

1.2.1 Market Covered

1.2.2 Years Considered In The Report

1.3 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Market Size Estimation

2.2 Market Breakdown & Data Triangulation

2.3 Key Data And Assumptions

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.3.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 24)

4.1 Introduction

4.2 Attractive Opportunities In Automotive Hud Market

4.3 Automotive Hud Market (Units): Key Countries

4.4 Automotive Hud Market Snapshot, 2014-2019 ($Million)

4.5 Automotive Hud Market, By Application ($Million): 2019

4.6 Premium Car Hud Market, By Region, 2014 Vs 2019

4.7 Luxury Car Hud Market, By Region, 2014 Vs 2019

4.8 Top Five Countries In Automotive Hud Market: Snapshot-2019

4.9 Life Cycle Analysis

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Hud Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand For Premium & Luxury Passenger Cars In Emerging Countries

5.3.1.2 Increasing Awareness For Safety Features Among Consumers

5.3.1.3 Rising Consumer Demand For Advanced Features

5.3.2 Restraints

5.3.2.1 High Cost Of Vehicle Integration

5.3.2.2 Underdeveloped Infrastructure In Developing Countries

5.3.3 Opportunities

5.3.3.1 Growing Luxury Car Market In China

5.3.4 Challenges

5.3.4.1 Integration Of Hud In Mid-Segment Cars

6 Industry Trends (Page No. - 35)

6.1 Introduction

6.2 Value Chain

6.3 Porter’s Five Forces Model

6.3.1 Threat Of New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power Of Suppliers

6.3.4 Bargaining Power Of Buyers

6.3.5 Intensity Of Competitive Rivalry

6.4 Pest

6.4.1 Political Factors

6.4.2 Economic Factors

6.4.3 Social Factors

6.4.4 Technological Factors

7 Global Automotive Hud Market, By Region (Page No. - 41)

7.1 Introduction

7.2 Asia-Oceania

7.2.1 China

7.2.2 Japan

7.2.3 South Korea

7.2.4 India

7.3 North America

7.3.1 U.S.

7.3.2 Canada

7.4 Europe

7.4.1 Germany

7.4.2 France

7.4.3 U.K.

7.5 Row

7.5.1 Russia

7.5.2 South Africa

8 Automotive Hud Market, By Application (Page No. - 62)

8.1 Introduction

8.2 Premium Car Hud Market

8.2.1 Asia-Oceania

8.2.2 North America

8.2.3 Europe

8.2.4 ROW

8.3 Luxury Car Hud Market

8.3.1 Asia-Oceania

8.3.2 North America

8.3.3 Europe

8.3.4 ROW

9 Automotive Hud Market, By Type (Page No. - 75)

9.1 Introduction

9.2 Windshield Projected

9.2.1 Asia-Oceania

9.2.2 North America

9.2.3 Europe

9.2.4 Row

9.3 Combiner Projected

9.3.1 Asia-Oceania

9.3.2 North America

9.3.3 Europe

9.3.4 ROW

10 Competitive Landscape (Page No. - 92)

10.1 Overview

10.2 Market Competition Of Automotive Hud System (By Company)

10.3 Competitive Situation And Trends

10.4 Battle For Market Share: New Product Launches And Development Was The Key Strategy

10.4.1 New Product Launches & Development

10.4.2 Agreements & Collaborations

10.4.3 Mergers And Acquisitions

10.4.4 Expansions

10.4.5 Supply Contracts

11 Company Profiles (Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 99)

11.1 Introduction

11.2 Nippon Seiki Co., Ltd.

11.3 Continental AG

11.4 Denso Corporation

11.5 Robert Bosch Gmbh

11.6 Visteon Corporation

11.7 Microvision, Inc.

11.8 Delphi Automotive PLC

11.9 Johnson Controls, Inc.

11.10 BMW AG

11.11 General Motors Company

*Details On Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured In Case Of Unlisted Companies.

List Of Tables (76 Tables)

Table 1 Automotive Hud Market Size, By Region, 2012-2019 (Units)

Table 2 Automotive Hud Market Size, By Region, 2012-2019 ($Million)

Table 3 Asia-Oceania: Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 4 Asia-Oceania: Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 5 China: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 6 China: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 7 Japan: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 8 Japan: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 9 South Korea: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 10 South Korea: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 11 India: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 12 India: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 13 North America: Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 14 North America: Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 15 U.S.: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 16 U.S.: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 17 Canada: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 18 Canada: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 19 Europe: Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 20 Europe: Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 21 Germany: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 22 Germany: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 23 France: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 24 France: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 25 U.K.: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 26 U.K.: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 27 Row: Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 28 Row: Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 29 Russia: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 30 Russia: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 31 South Africa: Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 32 South Africa: Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 33 Automotive Hud Market Size, By Application, 2012-2019 (Units)

Table 34 Automotive Hud Market Size, By Application, 2012-2019 ($Million)

Table 35 Premium Car Hud Market Size, By Region, 2012-2019 (Units)

Table 36 Premium Car Hud Market Size, By Region, 2012-2019 ($Million)

Table 37 Asia-Oceania: Premium Car Hud Market Size, By Country, 2012-2019 (Units)

Table 38 Asia-Oceania: Premium Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 39 North America: Premium Car Hud Market Size, By Country, 2012-2019 (Units)

Table 40 North America: Premium Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 41 Europe: Premium Car Hud Market Size, By Country, 2012-2019 (Units)

Table 42 Europe: Premium Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 43 Row: Premium Car Hud Market Size, By Country, 2012-2019 (Units)

Table 44 Row: Premium Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 45 Luxury Car Hud Market Size, By Region, 2012-2019 (Units)

Table 46 Luxury Car Hud Market Size, By Region, 2012-2019 ($Million)

Table 47 Asia-Oceania: Luxury Car Hud Market Size, By Country, 2012-2019 (Units)

Table 48 Asia-Oceania: Luxury Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 49 North America: Luxury Car Hud Market Size, By Country, 2012-2019 (Units)

Table 50 North America: Luxury Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 51 Europe: Luxury Car Hud Market Size, By Country, 2012-2019 (Units)

Table 52 Europe: Luxury Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 53 ROW: Luxury Car Hud Market Size, By Country, 2012-2019 (Units)

Table 54 ROW: Luxury Car Hud Market Size, By Country, 2012-2019 ($Million)

Table 55 Automotive Hud Market Size, By Type, 2012-2019 (Units)

Table 56 Automotive Hud Market Size, By Type, 2012-2019 ($Million)

Table 57 Windshield Projected Automotive Hud Market Size, By Region, 2012-2019 (Units)

Table 58 Windshield Projected Automotive Hud Market Size, By Region, 2012-2019 ($Million)

Table 59 Asia-Oceania: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 60 Asia-Oceania: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 61 North America: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 62 North America: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 63 Europe: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 64 Europe: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 65 ROW: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 66 ROW: Windshield Projected Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 67 Combiner Automotive Hud Market Size, By Region, 2012-2019 (Units)

Table 68 Combiner Automotive Hud Market Size, By Region, 2012-2019 ($Million)

Table 69 Asia-Oceania: Combiner Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 70 Asia-Oceania: Combiner Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 71 North America: Combiner Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 72 North America: Combiner Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 73 Europe: Combiner Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 74 Europe: Combiner Automotive Hud Market Size, By Country, 2012-2019 ($Million)

Table 75 ROW: Combiner Automotive Hud Market Size, By Country, 2012-2019 (Units)

Table 76 ROW: Combiner Automotive Hud Market Size, By Country, 2012-2019 ($Million)

List of Figures (65 Figures)

Figure 1 Hud Market Segmentation

Figure 2 Automotive Hud Market: Research Methodology

Figure 3 Automotive Hud Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Automotive Hud Market Size: Key Countries (Units)

Figure 5 Automotive Hud Market Share: Europe Projected To Be The Fastest Growing Market ($Million)

Figure 6 Automotive Hud Market, By Application & Type, 2014 Vs 2019 ($Million)

Figure 7 Attractive Opportunities In Automotive Hud Market

Figure 8 U.S. Estimated To Be The Largest Automotive Hud Market

Figure 9 Germany Projected To Grow At The Highest Rate

Figure 10 Automotive Hud Market, By Application, 2019

Figure 11 North American Region Estimated To Be The Largest Market

Figure 12 Asia-Oceania Estimated To Be The Largest Market By 2019

Figure 13 Germany To Hold The Highest Share Of The Luxury Car Hud Market By 2019 28

Figure 14 China And U.K. To Hold Highest Share Of Combiner Projected Hud Market By 2019

Figure 15 Nascent Stages In The Automotive Hud Market

Figure 16 Hud Market Segmentation: By Hud Type

Figure 17 Hud Market Segmentation: By Application

Figure 18 Hud Market Segmentation: By Region

Figure 19 Increasing Consumer Demand For Advanced Features To Drive The Demand For The Hud Market

Figure 20 Value Chain Analysis

Figure 21 Porter’s Five Forces Model

Figure 22 Automotive Head-Up Market Snapshot, 2014 Vs 2019 , North America Projected To Be The Largest Market In 2019 ($Million)

Figure 23 Asia-Oceania Automotive Hud Market ($Million): Demand For Premium And Luxury Cars To Drive The Market

Figure 24 China Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million)

Figure 25 North American Automotive Hud Market: U.S. To Hold Maximum Share

Figure 26 U.S. Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million)

Figure 27 Europe Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million): Germany To Be The Largest Market

Figure 28 Germany Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million)

Figure 29 Row Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million)

Figure 30 Russia Automotive Hud Market Snapshot, 2014 Vs 2019 ($Million)

Figure 31 2014 Vs 2019: Global Automotive Hud Market

Figure 32 Premium Car Hud Market: Snapshot

Figure 33 Luxury Car Hud Market: Snapshot

Figure 34 Automotive Windshield Projected Hud Market, By Type ($Million): Adoption Of Combiner Hud Estimated To Increase

Figure 35 Windshield Projected Automotive Hud Market: Europe Projected To Witness Highest Growth

Figure 36 Asia-Oceania Windshield Projected Automotive Hud Market, 2014 Vs 2019 ($Million) 79

Figure 37 North America Windshield Projected Automotive Hud Market, 2014 Vs 2019 ($Million) 80

Figure 38 Europe Windshield Projected Automotive Hud Market, 2014 Vs 2019 ($Million) 82

Figure 39 Row Windshield Projected Automotive Hud Market, 2014 Vs 2019 ($Million) 83

Figure 40 Global Combiner Hud Market: High Growth Anticipated During The Forecast Period

Figure 41 Asia-Oceania Automotive Combiner Hud Market Share, 2014 Vs 2019 ($Million) 86

Figure 42 North America Automotive Combiner Hud Market Share, 2014 Vs 2019 ($Million) 88

Figure 43 Europe Automotive Combiner Hud Market Share, 2014 Vs 2019 ($Million)

Figure 44 Row Automotive Combiner Hud Market Share, 2014 Vs 2019 ($Million)

Figure 45 Companies Adopted New Product Development As Their Key Growth Strategy Over The Past Five Years

Figure 46 Continental Ag Grew At The Fastest Rate From 2009–2013

Figure 47 Market Evolution Framework: Product Launch And Development Has Fueled Growth And Innovation In 2012 And 2014

Figure 48 New Product Launches And Development Was The Key Strategy Followed By Tier I Suppliers

Figure 49 Region-Wise Revenue Mix Of Top Five Players

Figure 50 Competitive Benchmarking Of Key Market Players (2009-2013)

Figure 51 Nippon Seiki Co., Ltd.: Business Overview

Figure 52 Nippon Seiki Co., Ltd.: Swot Analysis

Figure 53 Continental Ag: Business Overview

Figure 54 Continental Ag: Swot Analysis

Figure 55 Denso Corporation: Business Overview

Figure 56 Denso Corporation: Swot Analysis

Figure 57 Robert Bosch Gmbh: Business Overview

Figure 58 Robert Bosch Gmbh: Swot Analysis

Figure 59 Visteon Corporation: Business Overview

Figure 60 Visteon Corporation: Swot Analysis

Figure 61 Microvision, Inc.: Business Overview

Figure 62 Delphi Automotive Plc: Business Overview

Figure 63 Johnson Controls, Inc.: Business Overview

Figure 64 Bmw Ag: Business Overview

Figure 65 General Motors Company: Business Overview

掲載企業リスト

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

お問合わせはこちらから

お問合わせはこちらから