車載BYOD(モバイルデバイス接続)の世界市場2013-2018年:スマートフォン・タブレット vs 実装済みコネクテッドカー

Automotive Bring Your Own Device (BYOD) Market 2013-2018 - Smartphones & Tablets vs. Embedded Connected Car Systems

- 出版元:Visiongain(英国)出版元情報

- 発行年:2013年8月

- 定価 Single User License(1名様ライセンス) 1,699GBP(英国ポンド) / Department License(5名様ライセンス) 2,999GBP/ Site License 4,999GBP / Global Site License 6,999GBP

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文141ページになります。

- 商品コード:VGN095

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

【レポート紹介】

世界の自動車産業はインフォテインメント、安全、セキュリティや通信を目的として一層その設計にテレマティクスを導入しつつあります。一方、消費者の期待値もまた進化しており、自動車メーカーに対して先進接続システムの提案によって需要拡大を確保し続けることを迫っています。緊急時補助と盗難車追跡に対する政府規制はテレマティクス採用プロセスを加速しています。Visiongain社では2025年までにはすべての車が何らかの方法でモバイル接続されるものと予測しています。また同社ではコネクテッドカーの世界市場規模は2013年に217億ドルに達するものと推計しています。

車内での接続にはいくつかの異なる方法があります。メーカーによって最初から車に組込まれた方式か、あるいはスマートフォン・タブレット・モバイルの普及率と収益機会を拡大することが確実な、自前デバイス持込み方式(Bring Your Own Device: BYOD solution)などです。当レポートでは各接続タイプ別に2013年-2018年の収益金額、出荷数の詳細予測を検証します。また業界専門家への幅広い取材に基づき、市場の主要な成長要因と阻害要因を考察し、主要な技術的課題を分析しています。定性的な分析評価に加え、豊富な定量データには2013年から2018年に至る世界市場予測、サブ市場予測、主要地域別市場予測が含まれ、戦略的事業機会を明らかにしていきます

【レポート構成概要】

・全141ページ レポートページ

レポートページ

・141のデータ表、グラフ類

・業界専門家オピニオンインタビュー( Broadcom)

・BYOD / 実装コネクテッドカーの世界市場予測2013-2018年(金額&出荷数ベース)

- Global BYOD vs. Embedded Connected Car revenue forecasts from 2013-2023

- Global BYOD vs. Embedded Connected Car shipment forecasts from 2013-2023

・BYOD / 実装コネクテッドカーのサブ市場予測2013-2018年(金額&出荷数ベース)

- Global embedded solution revenues

- Global embedded solution shipments

- Global tethered solution revenues

- Global tethered solution shipments

- Global integrated solution revenues

- Global integrated solution shipments

- Global smartphone shipment forecast

- Global tablet shipment forecast

・地域別・サブ市場別、市場予測2013-2018年(金額&出荷数ベース)

- North America smartphone shipment forecast

- North America tablet shipment forecast

- North America embedded solutions revenues

- North America integrated solutions revenues

- North America tethered solutions revenues

- North America embedded solutions shipments

- North America integrated solutions shipments

- North America tethered solutions shipments

- Latin America smartphone shipment forecast

- Latin America tablet shipment forecast

- Latin America embedded solutions revenues

- Latin America integrated solutions revenues

- Latin America tethered solutions revenues

- Latin America embedded solutions shipments

- Latin America integrated solutions shipments

- Latin America tethered solutions shipments

- Europe smartphone shipment forecast

- Europe tablet shipment forecast

- Europe embedded solutions revenues

- Europe integrated solutions revenues

- Europe tethered solutions revenues

- Europe embedded solutions shipments

- Europe integrated solutions shipments

- Europe tethered solutions shipments

- Asia Pacific smartphone shipment forecast

- Asia Pacific tablet shipment forecast

- Asia Pacific embedded solutions revenues

- Asia Pacific integrated solutions revenues

- Asia Pacific tethered solutions revenues

- Asia Pacific embedded solutions shipments

- Asia Pacific integrated solutions shipments

- Asia Pacific tethered solutions shipments

- Middle East and Africa smartphone shipment forecast

- Middle East and Africa tablet shipment forecast

- Middle East and Africa embedded solutions revenues

- Middle East and Africa integrated solutions revenues

- Middle East and Africa tethered solutions revenues

- Middle East and Africa embedded solutions shipments

- Middle East and Africa integrated solutions shipments

- Middle East and Africa tethered solutions shipments

・BYOD / コネクテッドカーのリーディング企業17社プロフィール。コネクテッドカー分野での成功のための戦略情報

- Airbiquity

- Apple

- BMW

- Broadcom

- Chrysler

- Daimler

- Ford

- General Motors

- Honda

- Hughes Telematics

- Mahindra Satyam

- OnStar

- Qualcomm

- Sierra Wireless

- Toyota

- WirelessCar

- Volkswagen

・SWOT分析

Visiongain is a trading partner with the US Federal Government

【レポート詳細目次は当ページ下を参照ください】

英文詳細目次(table of contents)

詳細目次

【原文詳細目次】

Automotive Bring Your Own Device (BYOD) Market 2013-2018 - Smartphones & Tablets vs. Embedded Connected Car Systems

Table of Contents

1. Executive Summary

1.1 Global Market Overview

1.2 Industry Convergence - Targets and Goals

1.3 Benefits of This Report

1.4 Who is This Report For?

1.5 Methodology

1.6 Key Points Emerged From This Research

1.6.1 Global Connected Car Market Forecasts 2013-2018

1.6.2 Regional Smart Devices Shipment Forecasts 2013-2018

1.6.2.1 Smartphone Shipment Forecasts 2013-2018

1.6.2.2 Tablet Shipment Forecasts 2013-2018

1.6.2.3 Regional Connected Cars Using Embedded Solutions Shipment Forecasts 2013-2018

1.6.2.4 Regional Connected Cars Using Integrated Solutions Shipment Forecasts 2013-2018

1.6.2.5 Regional Connected Cars Using Tethered Solutions Shipment Forecasts 2013-2018

1.6.3 Regional Connected Car Revenue Forecasts 2013-2018

1.6.3.1 Regional Total Connected Car Revenue Forecasts 2013-2018

1.6.3.2 Regional Connected Car Revenue Forecasts from Embedded Solutions 2013-2018

1.6.3.3 Regional Connected Car Revenue Forecasts from Integrated Solutions 2013-2018

1.6.3.4 Regional Connected Car Revenue Forecasts from Tethered Solutions 2013-2018

2. Introduction to the BYOD vs. Embedded Connected Car Market

2.1 Connected Car Ecosystem Overview

2.2 Connected Car Definition

2.3 Connection Types

2.3.1 Embedded Connectivity

2.3.2 Connected Cars Using Integrated Systems

2.3.3 Connected Cars Using Tethered Smartphones and Tablets

2.4 The BYOD Market

2.4.1 Global Smartphone Shipment Forecast 2013-2018

2.4.1.1 Regional Smartphone Shipment Forecast 2013-2018

2.4.2 Global Tablet Shipment Forecast 2013-2018

2.4.2.1 Regional Tablet Shipment Forecast 2013-2018

3. Global BYOD Connected Car Forecasts 2013-2018

3.1 Global Connected Car Shipment Forecast by Connection Type 2013-2018

3.1.1 Global Embedded Connected Car Shipment Forecast 2013-2018

3.1.2 Global Integrated Connected Car Shipment Forecast 2013-2018

3.1.3 Global Tethered Connected Car Shipment Forecast 2013-2018

3.1.4 Global Not Connected Car Shipment Forecast 2013-2018

3.2 Global Total Connected Car Revenue Forecast 2013-2018

3.3 Global Connected Car Revenue Forecast by Connectivity Type2013-2018

3.3.1 Global Embedded Connected Car Revenue Forecast 2013-2018

3.3.2 Global Tethered Connected Car Revenue Forecast 2013-2018

3.3.3 Global Integrated Connected Car Revenue Forecast 2013-2018

4. Regional Automotive BYOD Connected Car Forecasts 2013-2018

4.1 Regional Total Connected Car Market Revenue Forecast Summary 2013-2018

4.2 Regional Connected Car Market Revenue Forecast for Embedded Solutions 2013-2018

4.3 Regional Connected Car Market Revenue Forecast for Tethered Solutions 2013-2018

4.4 Regional Connected Car Market Revenue Forecast for Integrated Solutions 2013-2018

4.5 Regional Connected Car with Embedded Solutions Shipment Forecast 2013-2018

4.6 Regional Connected Car with Integrated Solutions Shipment Forecast 2013-2018

4.7 Regional Connected Car with Tethered Solutions Shipment Forecast 2013-2018

4.8 North American Connected Car Market 2013-2018

4.8.1 Contributing Factors in North America's Connected Car Market Share 2013

4.8.2 North American Connected Car Total Revenue Forecast 2013-2018

4.8.3 North American Connected Car Shipment Forecast for Embedded Solutions 2013-2018

4.8.4 North American Connected Car Shipment Forecast for Integrated Solutions 2013-2018

4.8.5 North American Connected Car Shipment Forecast for Tethered Solutions 2013-2018

4.9 Latin American Connected Car Market 2013-2018

4.9.1 Latin American Total Connected Car Revenue Forecast 2013-2018

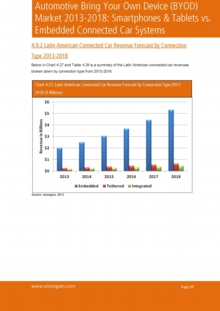

4.9.2 Latin American Connected Car Revenue Forecast by Connection Type 2013-2018

4.9.3 Latin American Connected Car Shipment Forecast for Embedded Solutions 2013-2018

4.9.4 Latin American Connected Car Shipment Forecast for Integrated Solutions 2013-2018

4.9.5 Latin American Connected Car Shipment Forecast for Tethered Solutions 2013-2018

4.10 What Factors are Driving Connected Car growth in Europe?

4.10.1 European Connected Car Market - Barriers to Entry 2013

4.10.2 European Total Connected Car Revenue Forecast 2013-2018

4.10.3 European Connected Car Revenue Forecast by Connection Type 2013-2018

4.10.4 European Connected Car Shipment Forecast for Embedded Solutions 2013-2018

4.10.5 European Connected Car Shipment Forecast for Integrated Solutions 2013-2018

4.10.6 European Connected Car Shipment Forecast for Tethered Solutions 2013-2018

4.11 Asia Pacific Connected Car Market 2013-2018

4.11.1 The Japanese Market Share 2013

4.11.2 Drivers and Restraints in the Japanese Telematics Market

4.11.3 The Chinese Connected Car Market 2013

4.11.4 How China's Densely Populated Areas Will Account for 95% of Telematics Usage

4.11.5 Asia Pacific Total Connected Car Revenue Forecast 2013-2018

4.11.6 Asia Pacific Connected Car Revenue Forecast by Connection Type 2013-2018

4.11.7 Asia Pacific Connected Car Shipment Forecast for Embedded Solutions 2013-2018

4.11.8 Asia Pacific Connected Car Shipment Forecast for Integrated Solutions 2013-2018

4.11.9 Asia Pacific Connected Car Shipment Forecast for Tethered Solutions 2013-2018

4.12 Middle East and African Connected Car Market 2013-2018

4.12.1 Middle East and African Total Connected Car Revenue Forecast 2013-2018

4.12.2 Middle East and African Connected Car Revenue Forecast by Connection Type 2013-2018

4.12.3 Middle East and Africa Connected Car Shipment Forecast for Embedded Solutions 2013-2018

4.12.4 Middle East and Africa Connected Car Shipment Forecast for Integrated Solutions 2013-2018

4.12.5 Middle East and Africa Connected Car Shipment Forecast for Tethered Solutions 2013-2018

5. Leading Companies in the BYOD Connected Car Market

5.1 Airbiquity

5.1.1 Airbiquity's Role in the Connected Car Market

5.1.2 Airbiquity's Future Outlook

5.2 Apple

5.2.1 Apple Move Towards the BYOD Connected Car Market

5.2.2 Apple to Take Automotive OS Marketshare

5.3 BMW AG

5.3.1 BMW's Role in the Connected Car Market

5.3.2 BMW's Future Outlook

5.4 Broadcom

5.4.1 Broadcom's Role in the Connected Car Market

5.4.1.1 Broadcom and the OPEN Alliance

5.5 Chrysler

5.5.1 Chrysler's Role in the Connected Car Market

5.5.2 Chrysler's Future Outlook

5.6 Daimler AG

5.6.1 Daimler's Role in the Connected Car Market

5.6.2 Daimler's Future Outlook

5.7 Ford

5.7.1 Ford's Role in the Connected Car Market

5.7.2 Ford's Future Outlook

5.7.3 Ford Switching Automotive OS?

5.8 General Motors

5.8.1 GM's Role in the Connected Car Market

5.8.2 GM's Future Outlook

5.9 Honda

5.9.1 Honda's Role in the Connected Car Market

5.9.2 Honda's Future Outlook

5.10 Hughes Telematics

5.10.1 HTI's Role in the Connected Car Market

5.10.2 HTI's Future Outlook

5.11 Mahindra Satyam

5.11.1 Mahindra Satyam's Role in the Connected Car Market

5.11.2 Mahindra Satyam's Future Outlook

5.12 OnStar

5.12.1 OnStar's Role in the Connected Car Market

5.12.2 OnStar's Future Outlook

5.13 Qualcomm

5.13.1 Qualcomm's Role in the Connected Car Market

5.13.2 Qualcomm's Future Outlook

5.14 Sierra Wireless

5.14.1 Sierra Wireless' Role in the Connected Car Market

5.14.2 Sierra Wireless' Future Outlook

5.15 Toyota

5.15.1 Toyota's Role in the Connected Car Market

5.15.2 Toyota's Future Outlook

5.16 WirelessCar

5.16.1 WirelessCar's Role in the Connected Car Market

5.16.2 WirelessCar's Future Outlook

5.17 Volkswagen Group

5.17.1 Volkswagen's Role in the Connected Car Market

5.17.2 Volkswagen's Future Outlook

5.18 Other Connected Car Companies of Note

6. Expert Opinion - Interview Broadcom

6.1 Broadcom in the Connected Car Space

6.2 Key Trends and Developments in the Connected Car Market

6.3 Driving Factors in the Connected Car Market

6.4 Restraining Factors in the Connected Car Market

6.5 Broadcom's Future Plans for the Connected Car Market

6.6 Connected Car Value Proposition

6.7 Mobile Operators in the Connected Car Space

6.8 Future Technological Developments in the Connected Car Space

6.9 Leading industry Sectors in the Connected Car Space

6.10 Regional Uptake of the Connected Car

6.11 Connected Car Growth Rates

6.12 Connected Car Challenges and Opportunities

6.13 Most Prevalent Method of Connectivity for Connected Cars by 2018

7. Connected Car - BYOD vs. Embedded SWOT Analysis

8. Smartphones & Tablets vs. Embedded Connected Car Systems Conclusions and Recommendations

8.1 Global Connected Car Market Drivers & Restraints

8.2 Global Connected Car Market Outlook 2013-2018

8.3 Regulatory Drivers

8.4 Privacy and Safety Barriers - Will they Halt Uptake?

8.5 BYOD vs. Embedded Which Will Ultimately Triumph?

8.6 Key Points Emerged From This Research

8.6.1 Global Connected Car Market Forecasts 2013-2018

8.6.2 Regional Connected Car Market Shipment Forecasts 2013-2018

8.6.2.1 Smartphone Shipment Forecasts 2013-2018

8.6.2.2 Tablet Shipment Forecasts 2013-2018

8.6.2.3 Regional Connected Cars Using Embedded Solutions Shipment Forecasts 2013-2018

8.6.2.4 Regional Connected Cars Using Integrated Solutions Shipment Forecasts 2013-2018

8.6.2.5 Regional Connected Cars Using Tethered Solutions Shipment Forecasts 2013-2018

8.6.3 Regional Connected Car Market Revenue Forecasts 2013-2018

8.6.3.1 Regional Total Connected Car Market Revenue Forecasts 2013-2018

8.6.3.2 Regional Connected Car Revenue Forecasts from Embedded Solutions 2013-2018

8.6.3.3 Regional Connected Car Revenue Forecasts from Integrated Solutions 2013-2018

8.6.3.4 Regional Connected Car Revenue Forecasts from Tethered Solutions 2013-2018

9. Glossary

List of Charts

Chart 2.3: Global Smartphone Shipment Forecast 2013-2018 (Millions, AGR %)

Chart 2.5: Regional Smartphone Shipment Forecast 2013-2018 (Millions)

Chart 2.7: Global Tablet Shipment Forecast 2013-2018 (Millions, AGR %)

Chart 2.9: Regional Tablet Shipment Forecast 2013-2018 (Millions)

Chart 3.1: Global Connected Car Shipments by Connection Type 2013-2018 (Millions)

Chart 3.3: Global Embedded Connected Car Shipments 2013-2018 (Millions, AGR %)

Chart 3.5: Global Integrated Connected Car Shipments 2013-2018 (Million, AGR %)

Chart 3.7: Global Tethered Connected Car Shipments 2013-2018 (Millions, AGR %)

Chart 3.9: Global Not Connected Car Shipments 2013-2018 (Millions, AGR %)

Chart 3.11: Global Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 3.13: Global Connected Car Revenue Forecast by Connectivity Type 2013-2018 ($ Billions)

Chart 3.15: Global Embedded Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 3.17: Global Tethered Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 3.19: Global Integrated Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.1: Regional Total Connected Car Market Revenue Forecast Summary 2013-2018 ($ Billions)

Chart 4.3: Regional Connected Car Market Revenue Forecast for Embedded Solutions 2013-2018 ($ Billions)

Chart 4.5: Regional Connected Car Market Revenue Forecast for Tethered Solutions 2013-2018 ($ Billions)

Chart 4.7: Regional Connected Car Market Revenue Forecast for Integrated Solutions 2013-2018 ($ Billions)

Chart 4.9: Regional Connected Car with Embedded Solutions Shipment Forecast 2013-2018 (Millions)

Chart 4.11: Regional Connected Car with Integrated Solutions Shipment Forecast 2013-2018 (Millions)

Chart 4.13: Regional Connected Car with Tethered Solutions Shipment Forecast 2013-2018 (Millions)

Chart 4.15: North American Connected Car Total Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.17: North American Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions)

Chart 4.19: North American Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %)

Chart 4.21: North American Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %)

Chart 4.23: North American Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %)

Chart 4.25: Latin American Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.27: Latin American Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions)

Chart 4.29: Latin American Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %)

Chart 4.31: Latin American Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %)

Chart 4.33: Latin American Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %)

Chart 4.35: European Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.37: European Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions)

Chart 4.39: European Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %)

Chart 4.41: European Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %)

Chart 4.43: European Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %)

Chart 4.45: Asia Pacific Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.47: Asia Pacific Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions)

Chart 4.49: Asia Pacific Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %)

Chart4.51: Asia Pacific Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %)

Chart 4.53: Asia Pacific Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %)

Chart 4.55: Middle East and African Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Chart 4.57: Middle East and African Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions)

Chart 4.59: Middle East and Africa Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %)

Chart 4.61: Middle East and Africa Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %

Chart 4.63: Middle East and Africa Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %)

Chart 5.3: Global Smartphone Shipments by Operating System Q2 2013 (Millions)

Chart 5.4: Global Smartphone Marketshare by Operating System Q2 2013 (%)

Chart 5.5: Global Automotive OS Market Share 2013 (%)

Chart 5.6: Global Automotive OS Market Share Forecast 2018 (%)

Chart 8.2: Global BYOD vs. Embedded System Connected Car Market Shares 2013-2018 (%)

List of Tables

Table 1.1: Summary of Key Global Connected Car Market Forecasts

Table 1.2: Regional Smartphone Shipment Forecast Summary 2013-2018

Table 1.3: Regional Tablet Shipment Forecast Summary 2013-2018

Table 1.4: Regional Connected Cars Using Embedded Solutions Shipment Forecasts 2013-2018

Table 1.5: Regional Connected Cars Using Integrated Solutions Shipment Forecasts 2013-2018

Table 1.6: Regional Connected Cars Using Tethered Solutions Shipment Forecasts 2013-2018

Table 1.7: Regional Total Connected Car Market Revenue Forecasts 2013-2018

Table 1.8: Regional Connected Car Revenue Forecasts from Embedded Solutions 2013-2018

Table 1.9: Regional Connected Car Revenue Forecasts from Integrated Solutions 2013-2018

Table 1.10: Regional Connected Car Revenue Forecasts from Tethered Solutions 2013-2018

Table 2.4: Global Smartphone Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 2.6: Regional Smartphone Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 2.8: Global Tablet Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 2.10: Regional Tablet Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 3.2: Global Connected Car Shipments by Connection Type 2013-2018 (Millions, AGR %, CAGR %)

Table 3.4: Global Embedded Connected Car Shipments 2013-2018 (Millions, AGR %, CAGR %)

Table 3.6: Global Integrated Connected Car Shipments 2013-2018 (Million, AGR %, CAGR %)

Table 3.8: Global Tethered Connected Car Shipments 2013-2018 (Millions, AGR %, CAGR %)

Table 3.10: Global Not Connected Car Shipments 2013-2018 (Millions, AGR %, CAGR %)

Table 3.12: Global Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 3.14: Global Connected Car Revenue Forecast by Connectivity Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 3.16: Global Embedded Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 3.18: Global Tethered Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 3.20: Global Integrated Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %)

Table 4.2: Regional Total Connected Car Market Revenue Forecast Summary 2013-2018 ($ Billions)

Table 4.4: Regional Connected Car Market Revenue Forecast for Embedded Solutions 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.6: Regional Connected Car Market Revenue Forecast for Tethered Solutions 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.8: Regional Connected Car Market Revenue Forecast for Integrated Solutions 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.10: Regional Connected Car with Embedded Solutions Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 4.12: Regional Connected Car with Integrated Solutions Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 4.14: Regional Connected Car with Tethered Solutions Shipment Forecast 2013-2018 (Millions, AGR %, CAGR %)

Table 4.16: North American Connected Car Total Revenue Forecast 2013-2018 ($ Billions, AGR %)

Table 4.18: North American Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.20: North American Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.22: North American Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.24: North American Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.26: Latin American Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.28: Latin American Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.30: Latin American Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.32: Latin American Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.34: Latin American Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.36: European Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.38: European Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.40: European Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.42: European Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.44: European Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.46: Asia Pacific Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.48: Asia Pacific Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.50: Asia Pacific Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.52: Asia Pacific Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.54: Asia Pacific Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.56: Middle East and African Total Connected Car Revenue Forecast 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.58: Middle East and African Connected Car Revenue Forecast by Connection Type 2013-2018 ($ Billions, AGR %, CAGR %)

Table 4.60: Middle East and Africa Connected Car Shipment Forecast for Embedded Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.62: Middle East and Africa Connected Car Shipment Forecast for Integrated Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 4.64: Middle East and Africa Connected Car Shipment Forecast for Tethered Solutions 2013-2018 (Millions, AGR %, CAGR %)

Table 5.1 Airbiquity Company Overview 2012 (HQ, Ticker, Contact, Website)

Table 5.2: Apple Company Overview 2012 (HQ, Ticker, Revenues, Website)

Table 5.7 BMW AG Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.8 Broadcom Company Overview 2012 (HQ, Ticker, Total Revenue, IR Contact, Website)

Table 5.9 Chrysler Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.10 Daimler AG Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.11 Ford Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.12: Ford Developer Program

Table 5.13 General Motors Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.14 Honda Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.15 Hughes Telematics Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.16 Mahindra Satyam Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.17 OnStar Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.18 Qualcomm Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.19 Sierra Wireless Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.20 Toyota Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.21 WirelessCar Company Overview 2012 (HQ, Ticker, Contact, Website)

Table 5.22 Volkswagen Group Company Overview 2012 (Total Revenue, HQ, Ticker, Contact, Website)

Table 5.23: Other Connected Car Companies of Note

Table 7.1: Connected Car - BYOD vs. Embedded SWOT Analysis

Table 8.1 Global Connected Car Market Drivers & Restraints

Table 8.3: Global BYOD vs. Embedded System Connected Car Market Shares 2013-2018 (%)

Table 8.4: Summary of Key Global Connected Car Market Forecasts

Table 8.5: Regional Smartphone Shipment Forecast Summary 2013-2018

Table 8.6: Regional Tablet Shipment Forecast Summary 2013-2018

Table 8.7: Regional Connected Cars Using Embedded Solutions Shipment Forecasts 2013-2018

Table 8.8: Regional Connected Cars Using Integrated Solutions Shipment Forecasts 2013-2018

Table 8.9: Regional Connected Cars Using Tethered Solutions Shipment Forecasts 2013-2018

Table 8.10: Regional Total Connected Car Market Revenue Forecasts 2013-2018

Table 8.11: Regional Connected Car Revenue Forecasts from Embedded Solutions 2013-2018

Table 8.12: Regional Connected Car Revenue Forecasts from Integrated Solutions 2013-2018

Table 8.13: Regional Connected Car Revenue Forecasts from Tethered Solutions 2013-2018

List of Figures

Figure 2.1: Connected Car Ecosystem

Figure 2.2: Connected Car Connection Types

掲載企業リスト

Companies Listed

AB Volvo

Accenture

Agilent

Airbiquity

Apple

AT&T Wireless

BMW AG

Broadcom

Chevrolet

Chrysler Group LLC

Continental

Daimler AG

Dell

Delphi

Denso

Ericsson

Federal Mogul

Fiat

Ford

Freescale Semiconductor

Fuji

Garmin

General Motors (GM)

Harman International

Honda Motor Company

Honeywell

Hughes Telematics

Hyundai

Hyundai Motor Company

Jaguar Land Rover Automotive PLC

LeCroy

Leoni

Magnetti Marelli

Mahindra Mahindra

Mahindra Satyam

Mazda

MD Electronics

Mitsubishi

Motorola

Navigon

Navistar

Navman

Nissan Motor Co.

NXP Semiconductors N.V.

OnStar

PSA Peugeot Citroen

Qualcomm

Renault

Ricardo plc

Robert Bosch GmbH

Rosenberger

Sagemcom

SAIC

Sierra Wireless

Sony

Sumatomo

Suzuki Motor Company

Telenor Conexxion

TeliaSonera

T-Mobile

Tomtom

Toyota Motor Corporation

Verizon Wireless

Volkswagen AG

Volvo

Wavecom

Wipro Technologies

WirelessCar

Yazaki

Government Agencies and Other Organisations Mentioned in This Report

Connected Car Forum (CCF)

Cooperative Vehicle Infrastructure Systems (CVIS)

GSMA: Group Special Mobile Association

OPEN Alliance

GENIVI Alliance

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

お問合わせはこちらから

お問合わせはこちらから