スパイスと調味料の世界市場:種類別、用途食品別2020年予測と動向

Spices and Seasonings Market by Type, Application (Meat & Poultry Products, Snacks & Convenience Food, Soups, Sauces, and Dressings, Bakery & Confectionery, Frozen Products, Beverages, and Others), & by Region - Global Trends and Forecast to 2020

- 出版元:MarketsandMarkets(米国)

出版元について

出版元について - 発行年:2016年2月

- 定価 Single User License(1名様ライセンス)US$5,650(米国ドル)/Multi User License(5名様)$6,650 /Corporate User License $8,150

- ご予算に応じた各種ご提案も承ります。詳細はお問い合わせください。

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文 189ページになります。

- 商品コード:MAM212

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

【レポート紹介】

スパイスと調味料の世界市場規模は、堅調な成長が続き2020年には148億ドル市場に達することが予測されます。世界的な都市化の進展、ライフスタイルや食生活の変化に伴うスナックやインスタント食品市場の成長は、スパイス調味料需要の促進要因の一つに挙げることができるでしょう。

当レポートでは、2020年に至るスパイスと調味料の世界市場予測(売上規模US$、出荷量トン)、種類別市場(コショウ、トウガラシ、ジンジャー、シナモン、クミン、ウコン、ナツメグ、カルダモン等々)、用途食品別市場(食肉製品、スナック、スープ・ソース・ドレッシング、ベーカリー製菓、冷凍食品、飲料等)、主要国地域別市場など詳細に区分された市場予測データと分析を掲載しています。また各種市場考察、主要メーカー企業10社動向などの調査情報も交えて、今後の市場展望を明らかにしていきます。

【レポート構成概要】

◆スパイスと調味料の世界市場予測2013-2020年

・市場規模(US$)

・出荷量(kt)

◆スパイス・調味料種類別、市場予測-2020と分析

(市場規模と出荷量)

・コショウ

・トウガラシ

・ジンジャー

・シナモン

・クミン

・ウコン

・ナツメグ&メイス

・カルダモン

・コリアンダー

・クローブ

・その他(parsley, fennel, juniper berries, saffron, vanilla, sesame, marjoram, oregano, thyme, bay leaves, rosemary, basil, mint, savory, dill, tarragon, sage, mustard, anise, allspice, wasabi, and dehydrated vegetables such as onions)

◆用途食品別、市場予測-2020と分析

(※市場規模と出荷量)

・食肉製品(meat & poultry products)

・スナックとインスタント食品(snacks & convenience foods)

・スープ、ソース、ドレッシング

・ベーカリーと製菓

・冷凍食品

・飲料

・その他食品用途(spice blends and premixes, dairy products, sweets, liquors, pickles, and functional foods)

◆主要国地域別、市場予測-2020と分析

(※市場規模と出荷量)

北米

・米国、カナダ、メキシコ

欧州

・ドイツ、英国、フランス

・その他欧州

アジア太平洋

・中国、インド、日本

・その他アジア太平洋

南米

・ブラジル

・アルゼンチン

・その他南米

その他地域(rest of the world)

・南アフリカ

・その他地域

◆市場考察

・サプライチェーン分析

・ポーターのファイブフォース分析(業界競合分析モデル)

・市場の促進要因と阻害要因、機会と課題

・競合状況

・新製品、提携動向等

◆主要メーカー企業10社動向

・MCCORMICK & COMPANY

・OLAM INTERNATIONAL

・味の素株式会社

・ASSOCIATED BRITISH FOODS PLC

・KERRY GROUP PLC

・アリアケジャパン株式会社

・SENSIENT TECHNOLOGIES

・DÖHLER GROUP

・SHS GROUP

・WORLÉE GRUPPE

【レポート詳細目次、データ項目一覧は当ページ下を参照ください】

英文詳細目次(table of contents)

【原文詳細目次】

Spices and Seasonings Market by Type, Application (Meat & Poultry Products, Snacks & Convenience Food, Soups, Sauces, and Dressings, Bakery & Confectionery, Frozen Products, Beverages, and Others), & by Region - Global Trends and Forecast to 2020

Table of Contents

1 INTRODUCTION 17

1.1 OBJECTIVES OF THE STUDY 17

1.2 MARKET DEFINITION 17

1.3 MARKET SCOPE 18

1.3.1 YEARS CONSIDERED FOR THE STUDY 18

1.4 CURRENCY 19

1.5 UNITS 19

1.6 STAKEHOLDERS 19

1.7 LIMITATIONS 19

2 RESEARCH METHODOLOGY 20

2.1 RESEARCH DATA 20

2.2 MARKET SHARE ESTIMATION 21

2.2.1 SECONDARY DATA 21

2.2.1.1 Key data from secondary sources 21

2.2.2 PRIMARY DATA 22

2.2.2.1 Key data from primary sources 22

2.2.2.2 Key industry insights 23

2.2.2.3 Breakdown of primaries 23

2.2.3 INTRODUCTION 24

2.2.4 OVERVIEW OF PARENT INDUSTRY 24

2.2.4.1 Key factors influencing the parent market 25

2.2.5 DEMAND-SIDE ANALYSIS 26

2.2.5.1 Developing economies 26

2.2.5.2 Growing middle-class population 27

2.2.6 SUPPLY-SIDE ANALYSIS 28

2.2.6.1 Regulations 28

2.3 MARKET SIZE ESTIMATION 29

2.4 MARKET BREAKDOWN & DATA TRIANGULATION 31

2.4.1 ASSUMPTIONS 32

3 EXECUTIVE SUMMARY 33

3.1 OVERVIEW 33

3.2 GLOBAL SPICES AND SEASONINGS MARKET 34

4 PREMIUM INSIGHTS 38

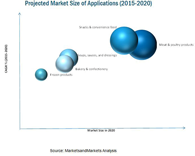

4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR SPICES AND SEASONINGS PRODUCERS AND PROCESSORS 38

4.2 SPICES AND SEASONINGS MARKET SIZE, BY REGION, 2013-2020, (KT) 39

4.3 SPICES AND SEASONINGS MARKET IN NORTH AMERICA, 2014 40

4.4 SPICES AND SEASONINGS MARKET, BY TYPE, VALUE & VOLUME (2014 VS. 2020) 41

4.5 SPICES AND SEASONINGS MARKET, BY APPLICATION (KT) 42

4.6 SPICES AND SEASONINGS MARKET POTENTIAL 43

5 MARKET OVERVIEW 44

5.1 INTRODUCTION 45

5.2 MARKET SEGMENTATION 46

5.2.1 SPICES AND SEASONINGS TYPE 47

5.2.2 APPLICATION 47

5.3 MARKET DYNAMICS 48

5.3.1 DRIVERS 49

5.3.1.1 Growing Demand for Convenience Foods 49

5.3.1.1.1 Rapidly increasing urbanization and changing lifestyles 49

5.3.1.1.2 Demand for convenience food 49

5.3.1.2 Clean label: a clear trend across global food markets 50

5.3.1.3 Increased use of spices and seasonings as natural preservatives in meat & poultry products 50

5.3.2 RESTRAINTS 51

5.3.2.1 Adulteration of spices 51

5.3.3 OPPORTUNITIES 51

5.3.3.1 Increasing demand for health and wellness products 51

5.3.4 CHALLENGES 52

5.3.4.1 Spices and seasonings are prone to microbial contamination 52

6 INDUSTRY TRENDS 53

6.1 INTRODUCTION 53

6.2 SPICES AND SEASONINGS MARKET: SUPPLY CHAIN ANALYSIS 53

6.3 SPICES AND SEASONINGS MARKET: PORTERS FIVE FORCES ANALYSIS 54

6.3.1 INTENSITY OF COMPETITIVE RIVALRY 55

6.3.2 BARGAINING POWER OF SUPPLIERS 55

6.3.3 BARGAINING POWER OF BUYERS 56

6.3.4 THREAT OF SUBSTITUTES 56

6.3.5 THREAT OF NEW ENTRANTS 56

7 SPICES AND SEASONINGS MARKET, BY TYPE 57

7.1 INTRODUCTION 58

7.2 PEPPER 61

7.3 CAPSICUM 62

7.4 GINGER 64

7.5 CINNAMON 66

7.6 CUMIN 67

7.7 TURMERIC 69

7.8 NUTMEG & MACE 70

7.9 CARDAMOM 72

7.10 CORIANDER 73

7.11 CLOVES 75

7.12 OTHERS 76

8 SPICES AND SEASONINGS MARKET, BY APPLICATION 78

8.1 INTRODUCTION 79

8.2 MEAT & POULTRY PRODUCTS 81

8.3 SNACKS & CONVENIENCE FOOD 83

8.4 SOUPS, SAUCES, AND DRESSINGS 84

8.5 BAKERY & CONFECTIONERY 86

8.6 FROZEN PRODUCTS 88

8.7 BEVERAGES 89

8.8 OTHER APPLICATIONS 91

9 SPICES AND SEASONINGS MARKET, BY REGION 92

9.1 INTRODUCTION 93

9.2 NORTH AMERICA 96

9.2.1 NORTH AMERICA: SPICES AND SEASONINGS MARKET, BY TYPE 99

9.2.2 NORTH AMERICA: SPICES AND SEASONINGS MARKET, BY APPLICATION 101

9.2.3 U.S.: SPICES AND SEASONINGS MARKET, BY APPLICATION 103

9.2.4 CANADA: SPICES AND SEASONINGS MARKET, BY APPLICATION 104

9.2.5 MEXICO: SPICES AND SEASONINGS MARKET, BY APPLICATION 106

9.3 EUROPE 108

9.3.1 EUROPE: SPICES AND SEASONINGS MARKET, BY TYPE 110

9.3.2 EUROPE: SPICES AND SEASONINGS MARKET, BY APPLICATION 112

9.3.3 GERMANY: SPICES AND SEASONINGS MARKET, BY APPLICATION 113

9.3.4 U.K.: SPICES AND SEASONINGS MARKET, BY APPLICATION 115

9.3.5 FRANCE: SPICES AND SEASONINGS MARKET, BY APPLICATION 116

9.3.6 REST OF EUROPE: SPICES AND SEASONINGS MARKET, BY APPLICATION 118

9.4 ASIA-PACIFIC 119

9.4.1 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET, BY TYPE 122

9.4.2 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET, BY APPLICATION 124

9.4.3 CHINA: SPICES AND SEASONINGS MARKET, BY APPLICATION 126

9.4.4 INDIA: SPICES AND SEASONINGS MARKET, BY APPLICATION 127

9.4.5 JAPAN: SPICES AND SEASONINGS MARKET, BY APPLICATION 129

9.4.6 REST OF ASIA-PACIFIC: SPICES AND SEASONINGS MARKET, BY APPLICATION 131

9.5 LATIN AMERICA 134

9.5.1 LATIN AMERICA: SPICES AND SEASONINGS MARKET, BY TYPE 135

9.5.2 LATIN AMERICA: SPICES AND SEASONINGS MARKET, BY APPLICATION 137

9.5.3 BRAZIL: SPICES AND SEASONINGS MARKET, BY APPLICATION 138

9.5.4 ARGENTINA: SPICES AND SEASONINGS MARKET, BY APPLICATION 140

9.5.5 REST OF LATIN AMERICA: SPICES AND SEASONINGS MARKET,

BY APPLICATION 141

9.6 REST OF THE WORLD (ROW) 143

9.6.1 ROW: SPICES AND SEASONINGS MARKET, BY TYPE 144

9.6.2 ROW: SPICES AND SEASONINGS MARKET, BY APPLICATION 146

9.6.3 SOUTH AFRICA: SPICES AND SEASONINGS MARKET, BY APPLICATION 147

9.6.4 OTHERS IN ROW: SPICES AND SEASONINGS MARKET, BY APPLICATION 149

10 COMPETITIVE LANDSCAPE 151

10.1 OVERVIEW 151

10.2 MAXIMUM DEVELOPMENTS IN ASIA-PACIFIC 152

10.3 AJINOMOTO CO., INC.: MOST ACTIVE KEY PLAYER IN THE SPICES AND SEASONINGS MARKET 153

10.4 HIGHEST NUMBER OF DEVELOPMENTS, 2013 & 2014 153

10.5 COMPETITIVE SITUATION AND TRENDS 154

10.5.1 EXPANSIONS 154

10.5.2 ACQUISITIONS 155

10.5.3 NEW PRODUCT LAUNCHES 155

10.5.4 JOINT VENTURE, INVESTMENTS, AND CONSOLIDATIONS 156

11 COMPANY PROFILES 157

(Company at a Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MNM View)*

11.1 INTRODUCTION 157

11.2 MCCORMICK & COMPANY 158

11.3 OLAM INTERNATIONAL 161

11.4 AJINOMOTO CO., INC. 164

11.5 ASSOCIATED BRITISH FOODS PLC 168

11.6 KERRY GROUP PLC 171

11.7 ARIAKE JAPAN CO., LTD. 174

11.8 SENSIENT TECHNOLOGIES 176

11.9 DÖHLER GROUP 178

11.10 SHS GROUP 180

11.11 WORLÉE GRUPPE 181

*Details on company at a glance, recent financials, Products offered, strategies & insights, & recent developments might not be captured in case of unlisted companies.

12 APPENDIX 183

12.1 DISCUSSION GUIDE 183

12.2 COMPANY DEVELOPMENTS 185

12.2.1 EXPANSIONS 185

12.2.2 NEW PRODUCT LAUNCH 186

12.2.3 ACQUISITIONS 186

12.2.4 JOINT VENTURE 187

12.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE 188

12.4 AVAILABLE CUSTOMIZATIONS 189

12.5 RELATED REPORTS 189

LIST OF TABLES

TABLE 1 SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2013-2020 (USD MILLION) 59

TABLE 2 SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2013-2020 (KT) 60

TABLE 3 PEPPER MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 61

TABLE 4 PEPPER MARKET SIZE, BY REGION, 2013-2020 (KT) 62

TABLE 5 CAPSICUM MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 63

TABLE 6 CAPSICUM MARKET SIZE, BY REGION, 2013-2020 (KT) 64

TABLE 7 GINGER MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 65

TABLE 8 GINGER MARKET SIZE, BY REGION, 2013-2020 (KT) 65

TABLE 9 CINNAMON MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 66

TABLE 10 CINNAMON MARKET SIZE, BY REGION, 2013-2020 (KT) 67

TABLE 11 CUMIN MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 68

TABLE 12 CUMIN MARKET SIZE, BY REGION, 2013-2020 (KT) 68

TABLE 13 TURMERIC MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 69

TABLE 14 TURMERIC MARKET SIZE, BY REGION, 2013-2020 (KT) 70

TABLE 15 NUTMEG & MACE MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 71

TABLE 16 NUTMEG & MACE MARKET SIZE, BY REGION, 2013-2020 (KT) 71

TABLE 17 CARDAMOM MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 72

TABLE 18 CARDAMOM MARKET SIZE, BY REGION, 2013-2020 (KT) 73

TABLE 19 CORIANDER MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 74

TABLE 20 CORIANDER MARKET SIZE, BY REGION, 2013-2020 (KT) 74

TABLE 21 CLOVES MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 75

TABLE 22 CLOVES MARKET SIZE, BY REGION, 2013-2020 (KT) 76

TABLE 23 OTHERS MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 76

TABLE 24 OTHERS MARKET SIZE, BY REGION, 2013-2020 (KT) 77

TABLE 25 SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 80

TABLE 26 SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 81

TABLE 27 MEAT & POULTRY PRODUCTS MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 82

TABLE 28 MEAT & POULTRY PRODUCTS MARKET SIZE, BY REGION, 2013–2020 (KT) 82

TABLE 29 SNACKS & CONVENIENCE FOOD MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 83

TABLE 30 SNACKS & CONVENIENCE FOOD MARKET SIZE, BY REGION, 2013–2020 (KT) 84

TABLE 31 SOUPS, SAUCES, AND DRESSINGS MARKET SIZE, BY REGION,

2013–2020 (USD MILLION) 85

TABLE 32 SOUPS, SAUCES, AND DRESSINGS MARKET SIZE, BY REGION, 2013–2020 (KT) 86

TABLE 33 BAKERY & CONFECTIONERY MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 87

TABLE 34 BAKERY & CONFECTIONERY MARKET SIZE, BY REGION, 2013–2020 (KT) 87

TABLE 35 FROZEN RPODUCTS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 88

TABLE 36 FROZEN PRODUCTS MARKET SIZE, BY REGION, 2013–2020 (KT) 89

TABLE 37 BEVERAGES MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 90

TABLE 38 BEVERAGES MARKET SIZE, BY REGION, 2013–2020 (KT) 90

TABLE 39 OTHER APPLICATIONS MARKET SIZE, BY REGION, 2013–2020 (USD MILLION) 91

TABLE 40 OTHER APPLICATIONS MARKET SIZE, BY REGION, 2013–2020 (KT) 91

TABLE 41 SPICES AND SEASONINGS MARKET SIZE, BY REGION, 2013-2020 (USD MILLION) 94

TABLE 42 SPICES AND SEASONINGS MARKET SIZE, BY REGION, 2013-2020 (KT) 95

TABLE 43 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 98

TABLE 44 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (KT) 99

TABLE 45 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 100

TABLE 46 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (KT) 101

TABLE 47 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 102

TABLE 48 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 102

TABLE 49 U.S.: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 103

TABLE 50 U.S.: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 104

TABLE 51 CANADA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 105

TABLE 52 CANADA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 106

TABLE 53 MEXICO: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 107

TABLE 54 MEXICO: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 108

TABLE 55 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 109

TABLE 56 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY, 2013–2020 (KT) 110

TABLE 57 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 111

TABLE 58 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2013–2020 (KT) 111

TABLE 59 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 112

TABLE 60 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 113

TABLE 61 GERMANY: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 114

TABLE 62 GERMANY: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 114

TABLE 63 U.K.: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 115

TABLE 64 U.K.: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 116

TABLE 65 FRANCE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 117

TABLE 66 FRANCE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 117

TABLE 67 REST OF EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 118

TABLE 68 REST OF EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 119

TABLE 69 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 121

TABLE 70 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (KT) 122

TABLE 71 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 123

TABLE 72 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2013–2020 (KT) 124

TABLE 73 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 125

TABLE 74 ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 125

TABLE 75 CHINA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 126

TABLE 76 CHINA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 127

TABLE 77 INDIA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 128

TABLE 78 INDIA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 129

TABLE 79 JAPAN: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 130

TABLE 80 JAPAN: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 131

TABLE 81 REST OF ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION) 132

TABLE 82 REST OF ASIA-PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 133

TABLE 83 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 134

TABLE 84 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (KT) 135

TABLE 85 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 136

TABLE 86 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (KT) 136

TABLE 87 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 137

TABLE 88 LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 138

TABLE 89 BRAZIL: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 139

TABLE 90 BRAZIL: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 139

TABLE 91 ARGENTINA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 140

TABLE 92 ARGENTINA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 141

TABLE 93 REST OF LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION) 142

TABLE 94 REST OF LATIN AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 142

TABLE 95 ROW: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY,

2013–2020 (USD MILLION) 143

TABLE 96 ROW: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY, 2013–2020 (KT) 144

TABLE 97 ROW: SPICES AND SEASONINGS MARKET SIZE, BY TYPE,

2013–2020 (USD MILLION) 145

TABLE 98 ROW: SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2013–2020 (KT) 145

TABLE 99 ROW: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 146

TABLE 100 ROW: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2013–2020 (KT) 147

TABLE 101 SOUTH AFRICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 148

TABLE 102 SOUTH AFRICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 148

TABLE 103 OTHERS IN ROW: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (USD MILLION) 149

TABLE 104 OTHERS IN ROW: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION,

2013–2020 (KT) 150

TABLE 105 EXPANSIONS, 2012–2015 154

TABLE 106 ACQUISITIONS, 2011–2015 155

TABLE 107 NEW PRODUCT LAUNCHES, 2012–2015 155

TABLE 108 JOINT VENTURES, INVESTMENTS, AND CONSOLIDATIONS, 2012–2014 156

LIST OF FIGURES

FIGURE 1 SPICES AND SEASONINGS MARKET: RESEARCH DESIGN 20

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION & REGION 23

FIGURE 3 GDP (PPP) OF TOP ECONOMIES, 2014 26

FIGURE 4 MIDDLE-CLASS POPULATION IN ASIA-PACIFIC PROJECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE GLOBAL MARKET BY 2030 27

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 29

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH 30

FIGURE 7 MARKET BREAKDOWN & DATA TRIANGULATION 31

FIGURE 8 SPICES AND SEASONINGS MARKET, BE TYPE, 2014 VS. 2020 (USD MILLION) 35

FIGURE 9 SNACKS & CONVENIENCE APPLICATION SEGMENT TO REGISTER THE HIGHEST CAGR IN TERMS OF VALUE BETWEEN 2015 & 2020 36

FIGURE 10 INDIA IS PROJECTED TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR SPICES AND SEASONINGS 37

FIGURE 11 ATTRACTIVE GROWTH OPPORTUNITIES IN SPICES AND SEASONINGS MARKET FOR MANUFACTURERS 38

FIGURE 12 SPICES AND SEASONINGS MARKET: ASIA-PACIFIC TO GROW AT THE FASTEST RATE FROM 2015 TO 2020 39

FIGURE 13 THE U.S. ACCOUNTED FOR THE LARGEST SHARE IN THE GLOBAL SPICES AND SEASONINGS MARKET IN 2014 40

FIGURE 14 CAPSICUM SEGMENT TO GROW AT THE HIGHEST CAGR FROM 2015 TO 2020 41

FIGURE 15 MEAT & POULTRY PRODUCTS SEGMENT DOMINATED THE SPICES AND SEASONINGS MARKET ACROSS ALL REGIONS IN 2014 42

FIGURE 16 ASIA-PACIFIC IS PROJECTED TO GROW AT THE HIGHEST CAGR 43

FIGURE 17 SPICES AND SEASONINGS MARKET SEGMENTATION 46

FIGURE 18 SPICES AND SEASONINGS MARKET SEGMENTATION, BY TYPE 47

FIGURE 19 SPICES AND SEASONINGS MARKET SEGMENTATION, BY APPLICATION 47

FIGURE 20 GROWING DEMAND FOR CONVENIENCE FOOD AND MEAT & POULTRY PRODUCTS IS EXPECTED TO DRIVE THE GLOBAL SPICES AND SEASONINGS MARKET IN THE FUTURE 48

FIGURE 21 SPICES AND SEASONINGS MARKET: SUPPLY CHAIN ANALYSIS 53

FIGURE 22 SPICES AND SEASONINGS MARKET : PORTERS FIVE FORCES ANALYSIS 54

FIGURE 23 SPICES AND SEASONINGS MARKET, BY TYPE 58

FIGURE 24 SPICES AND SEASONINGS MARKET, BY TYPE, 2014 VS. 2020 (USD MILLION) 59

FIGURE 25 PEPPER MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 61

FIGURE 26 CAPSICUM MARKET SIZE, BY REGION, 2014 VS. 2020 (USD MILLION) 63

FIGURE 27 GINGER MARKET SIZE, BY REGION, 2014 VS. 2020 (USD MILLION) 64

FIGURE 28 CINNAMON MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 66

FIGURE 29 CUMIN MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 67

FIGURE 30 TURMERIC MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 69

FIGURE 31 NUTMEG & MACE MARKET SIZE, BY REGION, 2014 VS. 2020 (USD MILLION) 70

FIGURE 32 CARDAMOM MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 72

FIGURE 33 CORIANDER MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 73

FIGURE 34 CLOVES MARKET, BY REGION, 2014 VS. 2020 (USD MILLION) 75

FIGURE 35 SPICES AND SEASONINGS MARKET, BY APPLICATION 79

FIGURE 36 MEAT & POULTRY PRODUCTS ACCOUNTED FOR LARGEST MARKET SIZE IN THE SPICES AND SEASONINGS MARKET IN 2014 80

FIGURE 37 NORTH AMERICA LED THE MEAT & POULTRY PRODUCTS SEGMENT OF THE SPICES AND SEASONINGS MARKET, 2014 81

FIGURE 38 NORTH AMERICA TO LEAD THE SNACKS & CONVENIENCE FOOD SEGMENT DURING THE FORECAST PERIOD 83

FIGURE 39 NORTH AMERICA TO DOMINATE THE SOUPS, SAUCES, AND DRESSINGS SEGMENT BY 2020 85

FIGURE 40 NORTH AMERICA IS PROJECTED TO LEAD THE BAKERY & CONFECTIONERY SEGMENT DURING THE FORECAST PERIOD 86

FIGURE 41 NORTH AMERICA IS PROJECTED TO LEAD THE FROZEN PRODUCTS SEGMENT DURING THE FORECAST PERIOD 88

FIGURE 42 NORTH AMERICA IS PROJECTED TO LEAD THE BEVERAGES SEGMENT DURING THE FORECAST PERIOD 89

FIGURE 43 NORTH AMERICA IS EXPECTED TO DOMINATE THE SPICES AND SEASONINGS MARKET BY 2020 94

FIGURE 44 REGIONAL SNAPSHOT: ASIA-PACIFIC AND LATIN AMERICA TO BE THE MOST ATTRACTIVE MARKETS FOR SPICES AND SEASONINGS PROCESSORS 95

FIGURE 45 NORTH AMERICAN SPICES AND SEASONINGS MARKET SNAPSHOT: U.S. ACCOUNTED FOR THE LARGEST SHARE 97

FIGURE 46 U.S. TO LEAD THE NORTH AMERICAN SPICES AND SEASONINGS MARKET BY 2020 98

FIGURE 47 PEPPER SEGMENT HELD THE LARGEST MARKET SIZE IN THE NORTH AMERICAN SPICES AND SEASONINGS MARKET IN 2014 99

FIGURE 48 MEAT & POULTRY PRODUCTS SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN THE NORTH AMERICAN SPICES AND SEASONINGS MARKET IN 2014 101

FIGURE 49 MEAT & POULTRY PRODUCTS SEGMENT IS PROJECTED TO LEAD THE U.S. SPICES AND SEASONINGS MARKET BY 2020 103

FIGURE 50 MEAT & POULTRY PRODUCTS SEGMENT DOMINATED THE CANADIAN SPICES AND SEASONINGS MARKET IN 2014 105

FIGURE 51 MEAT & POULTRY PRODUCTS SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MEXICAN SPICES AND SEASONINGS MARKET, 2015–2020 107

FIGURE 52 GERMANY IS EXPECTED TO DOMINATE THE SPICES AND SEASONINGS MARKET IN EUROPE DURING THE FORECAST PERIOD 109

FIGURE 53 PEPPER SEGMENT HELD THE LARGEST SHARE IN THE EUROPEAN SPICES AND SEASONINGS MARKET IN 2014 110

FIGURE 54 MEAT & POULTRY PRODUCTS SEGMENT TO GROW AT THE HIGHEST CAGR IN THE EUROPEAN SPICES AND SEASONINGS MARKET FROM 2015–2020 112

FIGURE 55 MEAT & POULTRY PRODUCTS SEGMENT IS EXPECTED TO DOMINATE THE GERMAN SPICES AND SEASONINGS MARKET BY 2020 113

FIGURE 56 MEAT & POULTRY PRODUCTS SEGMENT LED THE U.K. SPICES AND SEASONINGS MARKET IN 2014 115

FIGURE 57 MEAT & POULTRY PRODUCTS SEGMENT IS EXPECTED TO DOMINATE THE SPICES AND SEASONINGS MARKET IN FRANCE DURING THE FORECAST PERIOD 116

FIGURE 58 MEAT & POULTRY PRODUCTS SEGMENT TO GROW AT THE HIGHEST CAGR IN REST OF EUROPE’S SPICES AND SEASONINGS MARKET, 2015–2020 118

FIGURE 59 ASIA-PACIFIC SPICES AND SEASONINGS MARKET SNAPSHOT: INDIA ACCOUNTED FOR THE LARGEST MARKET SHARE, BY CONSUMPTION 120

FIGURE 60 CHINA TO DOMINATE THE MARKET FOR SPICES AND SEASONINGS IN ASIA-PACIFIC BY 2020 121

FIGURE 61 PEPPER HELD THE LARGEST SHARE IN THE ASIA-PACIFIC SPICES AND SEASONINGS MARKET IN 2014 122

FIGURE 62 SNACKS & CONVENIENCE FOOD SEGMENT HELD THE LARGEST SHARE IN THE ASIA-PACIFIC SPICES AND SEASONINGS MARKET IN 2014 124

FIGURE 63 SNACKS & CONVENIENCE FOOD SEGMENT LED THE CHINESE SPICES AND SEASONINGS MARKET IN 2014 126

FIGURE 64 SNACKS & CONVENIENCE FOOD SEGMENT TO GROW AT THE HIGHEST CAGR IN THE INDIAN SPICES AND SEASONINGS MARKET DURING THE FORECAST PERIOD 128

FIGURE 65 SNACKS & CONVENIENCE FOOD SEGMENT IS EXPECTED TO DOMINATE THE SPICES AND SEASONINGS MARKET IN JAPAN BY 2020 130

FIGURE 66 SNACKS & CONVENIENCE FOOD TO LEAD THE SPICES AND SEASONINGS MARKET IN REST OF ASIA-PACIFIC BY 2020 132

FIGURE 67 BRAZIL IS EXPECTED TO DOMINATE THE SPICES AND SEASONINGS MARKET IN LATIN AMERICA BY 2020 134

FIGURE 68 PEPPER HELD THE LARGEST SHARE IN THE LATIN AMERICAN SPICES AND SEASONINGS MARKET IN 2014 135

FIGURE 69 MEAT & POULTRY PRODUCTS ARE EXPECTED TO GROW AT THE HIGHEST CAGR IN THE LATIN AMERICAN SPICES AND SEASONINGS MARKET TILL 2020 137

FIGURE 70 SNACKS & CONVENIENCE FOOD SEGMENT IS PROJECTED TO LEAD THE BRAZILIAN SPICES AND SEASONINGS MARKET BY 2020 138

FIGURE 71 SNACKS & CONVENIENCE FOOD SEGMENT TO DOMINATE THE ARGENTINEAN SPICES AND SEASONINGS MARKET BY 2020 140

FIGURE 72 SNACKS & CONVENIENCE FOOD SEGMENT HELD THE LARGEST SHARE IN THE REST OF LATIN AMERICAN SPICES AND SEASONINGS MARKET IN 2014 141

FIGURE 73 SOUTH AFRICA TO LEAD THE ROW SPICES AND SEASONINGS MARKET DURING THE FORECAST PERIOD 143

FIGURE 74 PEPPER HELD THE LARGEST SHARE IN THE ROW SPICES AND SEASONINGS MARKET IN 2014 144

FIGURE 75 SNACKS & CONVENIENCE FOOD SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN THE ROW SPICES AND SEASONINGS MARKET IN 2014 146

FIGURE 76 SNACKS & CONVENIENCE FOOD SEGMENT IS PROJECTED TO LEAD THE SOUTH AFRICAN SPICES AND SEASONINGS MARKET BY 2020 147

FIGURE 77 SNACKS & CONVENIENCE FOOD SEGMENT TO DOMINATE THE OTHERS IN ROW SPICES AND SEASONINGS MARKET BY 2020 149

FIGURE 78 COMPANIES ADOPTED EXPANSIONS AND ACQUISITIONS AS THEIR KEY GROWTH STRATEGIES FROM 2011 TO 2015 151

FIGURE 79 KEY GROWTH STRATEGIES IN THE GLOBAL SPICES AND SEASONINGS MARKET, 2011–2015 152

FIGURE 80 ASIA-PACIFIC: MOST ACTIVE REGION FROM 2011 TO 2015 152

FIGURE 81 MOST ACTIVE COMPANIES, 2011–2015 153

FIGURE 82 NUMBER OF DEVELOPMENTS, 2011–2015 153

FIGURE 83 GEOGRAPHIC REVENUE MIX OF TOP FIVE MARKET PLAYERS 157

FIGURE 84 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT 158

FIGURE 85 MCCORMICK & COMPANY, INC.: SWOT ANALYSIS 160

FIGURE 86 OLAM INTERNATIONAL: COMPANY SNAPSHOT 161

FIGURE 87 OLAM INTERNATIONAL: SWOT ANALYSIS 163

FIGURE 88 AJINOMOTO CO., INC.: COMPANY SNAPSHOT 164

FIGURE 89 AJINOMOTO CO., INC.: SWOT ANALYSIS 167

FIGURE 90 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT 168

FIGURE 91 ASSOCIATED BRITISH FOODS PLC: SWOT ANALYSIS 169

FIGURE 92 KERRY GROUP PLC: COMPANY SNAPSHOT 171

FIGURE 93 KERRY GROUP PLC: SWOT ANALYSIS 173

FIGURE 94 ARIAKE JAPAN CO.,LTD.: COMPANY SNAPSHOT 174

FIGURE 95 SENSIENT TECHNOLOGIES: COMPANY SNAPSHOT 176

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

食品添加物の世界市場:タイプ別2020年市場予測

食品添加物の世界市場:タイプ別2020年市場予測

お問合わせはこちらから

お問合わせはこちらから