医療用センサの世界市場:タイプ別、用途別~2022年予測

Medical Sensors Market by Sensor Type (Temperature, ECG, Image, Motion, & Pressure), Placement (Strip, Wearable, Implantable, & Ingestible), Application (Diagnostics, Monitoring, Therapeutics, & Imaging), & Geography - Global Forecast to 2022

- 出版元:MarketsandMarkets(米国)

出版元について

出版元について - 発行年:2016年4月

- 定価 Single User License(1名様ライセンス)US$5,650(米国ドル)/Multi User License(5名様)$6,650 /Corporate User License $8,150

- ご予算に応じた各種ご提案も承ります。詳細はお問い合わせください。

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文206ページになります。

- 商品コード:MAM235

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

【レポート紹介】

医療用センサの世界市場規模は、2015年段階の82億ドルから今後2022年には150億ドル市場へと急成長が予測されます。ウェアラブル機器や患者モニタリング機器の使用増加、ポータブル医療機器、遠隔医療など用途市場の広がりは今後の市場成長の支持要因といえるでしょう。

当レポートでは2022年に至る医療用センサの世界市場予測(市場規模US$と出荷数)、センサタイプ別市場(温度、血糖値、血中酸素濃度、心電図、イメージ、モーション、慣性、圧力)、用途別市場(診断、モニタリング、治療、イメージング、フィットネス)、センサ使用形態・部位別市場、主要国地域別市場、など詳細に区分された細分化予測データと動向分析を掲載しています。また市場考察、競合分析、医療用センサの主要メーカー10社動向などの調査情報も交えて、今後の市場展望を明らかにしていきます。

【レポート構成概要】

◆医療用センサの世界市場予測2013-2022年

・市場規模(US$)

・出荷数(Units)

◆センサタイプ別、市場予測-2022と分析

(※市場規模$と出荷数Units)

・温度センサ

・血糖値センサ

・血中酸素濃度センサ

・心電図(ECG)センサ

・イメージセンサ

・モーションセンサ

・慣性センサ

・圧力センサ

◆用途別市場、-2022予測と動向

(※市場規模と出荷数データ掲載)

・診断

・モニタリング

・治療

・映像化(imaging)

・ウェルネス&フィットネス

◆センサ使用形態・部位別、市場

・血管センサ

・ウェアラブルセンサ

・インプラントセンサ

・侵襲性/非侵襲性センサ

・飲み込み型センサ(ingestible)

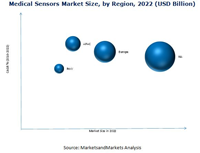

◆主要国地域別、市場予測-2022と分析

(※市場規模データ)

・北米地域

・米国、カナダ、メキシコ

・欧州地域

・ドイツ、英国、フランス

・その他欧州

・アジア太平洋地域

・日本、中国、インド

・その他アジア太平洋

・その他地域(Rest of the World)

※セグメント相互をクロス細分化した予測データを掲載、詳細は目次参照

◆市場考察、競合分析

◆医療用センサの主要メーカー企業10社動向

・GE HEALTHCARE

・HONEYWELL INTERNATIONAL INC.

・STMICROELECTRONICS N.V.

・MEASUREMENT SPECIALTIES, INC.

・ANALOG DEVICES, INC.

・MEDTRONIC PLC

・FIRST SENSOR AG

・SMITHS MEDICAL

・TEXAS INSTRUMENTS

・NXP SEMICONDUCTOR N.V.

【レポート詳細目次、データ項目一覧は当ページ下を参照ください】

英文詳細目次(table of contents)

【原文詳細目次】

Medical Sensors Market by Sensor Type (Temperature, ECG, Image, Motion, & Pressure), Placement (Strip, Wearable, Implantable, & Ingestible), Application (Diagnostics, Monitoring, Therapeutics, & Imaging), & Geography - Global Forecast to 2022

Table of Contents

1 INTRODUCTION 16

1.1 OBJECTIVES OF THE STUDY 16

1.2 MARKET DEFINITION 17

1.3 STUDY SCOPE 17

1.3.1 MARKETS COVERED 17

1.3.2 GEOGRAPHIC SCOPE 18

1.3.3 YEARS CONSIDERED FOR THE STUDY 18

1.4 CURRENCY 19

1.5 LIMITATIONS 19

1.6 STAKEHOLDERS 19

2 RESEARCH METHODOLOGY 20

2.1 RESEARCH DATA 20

2.1.1 SECONDARY DATA 21

2.1.1.1 Key data from secondary sources 21

2.1.2 PRIMARY DATA 21

2.1.2.1 Key data from primary sources 22

2.1.2.2 Key industry insights 23

2.1.2.3 breakdown of primary interviews 23

2.2 MARKET SIZE ESTIMATION 24

2.2.1 BOTTOM-UP-APPROACH 25

2.2.2 TOP-DOWN APPROACH 26

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION 27

3 EXECUTIVE SUMMARY 28

4 PREMIUM INSIGHTS 34

4.1 ATTRACTIVE OPPORTUNITIES IN THE MEDICAL SENSOR MARKET 34

4.2 INVASIVE/NON-INVASIVE PLACEMENT TYPE MARKET HELD THE LARGEST MARKET SHARE DURING 2015 35

4.3 THE APAC COUNTRIES EXPECTED TO GROW AT THE HIGHEST RATE IN THE MEDICAL SENSORS MARKET 36

4.4 LIFE CYCLE ANALYSIS, BY GEOGRAPHY 37

5 MARKET OVERVIEW 38

5.1 INTRODUCTION 39

5.2 MARKET EVOLUTION 40

5.3 MARKET SEGMENTATION 41

5.3.1 BY APPLICATION 42

5.3.2 BY TYPE 43

5.3.3 BY PLACEMENT 44

5.3.4 BY GEOGRAPHY 45

5.4 MARKET DYNAMICS 45

5.4.1 KEY MARKET DRIVERS 46

5.4.1.1 Increase in hospital-acquired infections (HAIs) 46

5.4.1.2 Technological advancements in the market such as wearable devices and disease detecting devices 47

5.4.1.3 Demand for personalization of healthcare systems 48

5.4.1.4 Increase in life expectancy and ageing of world population 48

5.4.1.5 Increase in individual disposable income and awareness of preventive measures 49

5.4.2 RESTRAINTS 49

5.4.2.1 Inadequate and irregular reimbursement/limited warranty coverage for medical devices 49

5.4.2.2 Slower rate of penetration of advanced medical systems in developing regions 50

5.4.3 OPPORTUNITIES 50

5.4.3.1 Emerging wireless sensor devices 50

5.4.3.2 Emerging applications of the capacitive sensors in the field of nanotechnology 51

5.4.3.3 Increasing number of merger and acquisition in growing economies 52

5.4.4 CHALLENGES 53

5.4.4.1 Stringent regulatory procedures for product approval 53

5.4.4.2 Security concerns in the devices and connectivity problems 54

5.5 PRICING TRENDS 54

6 INDUSTRY TREND 58

6.1 INTRODUCTION 58

6.2 VALUE CHAIN ANALYSIS 59

6.3 TECHNOLOGY ROADMAP 60

6.4 INNOVATION IN MEDICAL SENSOR 61

6.4.1 STICKY ORGAN SENSOR 61

6.4.2 INGESTIBLE SENSORS 61

6.4.3 BODY-WORN GLUCOSE SENSORS 62

6.4.4 WEARABLE UV SENSORS 62

6.4.5 PILL BOTTLE SENSORS 62

6.4.6 STICK-ON HEALTH MONITOR PATCH 62

6.4.7 ELECTRONICS SKIN SENSORS 62

6.4.8 BLOOD MONITORING SENSORS 62

6.4.9 BABY MONITORING SENSORS 62

6.5 PORTER’S FIVE FORCES ANALYSIS 63

6.5.1 INTENSITY OF COMPETITIVE RIVALRY 64

6.5.2 THREAT OF SUBSTITUTE 65

6.5.3 BARGAINING POWER OF BUYERS 66

6.5.4 BARGAINING POWER OF SUPPLIERS 67

6.5.5 THREAT OF NEW ENTRANT 68

7 MEDICAL SENSORS MARKET, BY SENSOR TYPE 69

7.1 INTRODUCTION 70

7.2 TEMPERATURE SENSORS 73

7.3 BLOOD GLUCOSE SENSORS 77

7.4 BLOOD OXYGEN SENSORS 79

7.5 ELECTROCARDIOGRAM (ECG) SENSORS 81

7.6 IMAGE SENSORS 84

7.7 MOTION SENSORS 86

7.8 INERTIAL SENSORS 90

7.9 PRESSURE SENSORS 92

7.9.1 RESPIRATORY DEVICES 92

7.9.2 PATIENT MONITORS 93

7.9.3 FUTURE SOLUTIONS 93

8 GLOBAL MEDICAL SENSORS MARKET, BY SENSOR PLACEMENT 96

8.1 INTRODUCTION 97

8.1.1 TECHNOLOGICAL ADVANCEMENTS AND INCREASING INNOVATIONS IN THE MEDICAL SENSORS MARKET 97

8.2 STRIP SENSORS 99

8.3 WEARABLE SENSORS 101

8.3.1 WEARABLE SENSORS POPULARITY IN DIAGNOSTICS AND PATIENT MONITORING APPLICATIONS 101

8.3.2 NON-INFECTIOUS CHARACTERISTICS OF WEARABLE SENSORS 102

8.4 IMPLANTABLE SENSORS 103

8.5 INVASIVE/NON-INVASIVE SENSORS 105

8.6 INGESTIBLE SENSORS 106

9 MEDICAL SENSOR MARKET, BY APPLICATION 108

9.1 INTRODUCTION 109

9.2 DIAGNOSTICS 111

9.2.1 HIV TEST STRIP SENSORS 112

9.2.2 BLOOD GLUCOSE TEST STRIP SENSORS 113

9.2.3 PREGNANCY TEST STRIP SENSORS 113

9.2.4 DRUG AND ALCOHOL TEST STRIP SENSORS 113

9.3 THERAPEUTICS 113

9.3.1 CARDIAC THERAPEUTIC DEVICES 115

9.3.2 CARDIAC CATHETER SENSORS 115

9.3.3 INSULIN PUMP SENSORS 116

9.4 MONITORING 117

9.4.1 CONTINUOUS BLOOD PRESSURE MONITORS 118

9.4.2 PULSE OXIMETERS 119

9.4.3 CARDIAC MONITORS 119

9.4.4 CONTINUOUS GLUCOSE MONITORING (CGM) DEVICES 120

9.4.5 IMPLANTABLE LOOP RECORDER 121

9.4.6 SMART PILLS 121

9.5 IMAGING DEVICES 121

9.5.1 CAPSULE ENDOSCOPE SENSORS 122

9.6 FITNESS AND WELLNESS 123

9.6.1 ELECTRONIC PEDOMETER 124

9.6.2 WEARABLE INJECTORS 124

9.6.3 CONTINUOUS GLUCOSE MONITOR (CGM) 124

9.6.4 OTHERS 125

9.6.4.1 Automated external defibrillator (AED) 125

9.6.4.2 Electronic weighing scale 125

9.6.4.3 Treadmill 125

9.6.4.4 Hearing aids 125

10 GEOGRAPHIC ANALYSIS 126

10.1 INTRODUCTION 127

10.2 PESTEL ANALYSIS 127

10.2.1 POLITICAL FACTORS 128

10.2.2 ECONOMIC FACTORS 129

10.2.3 SOCIOLOGICAL FACTORS 129

10.2.4 TECHNOLOGICAL FACTORS 130

10.2.5 ENVIRONMENTAL FACTORS 131

10.2.6 LEGAL FACTORS 131

10.3 REGULATORY FRAMEWORK OF MEDICAL SENSORS: REGION WISE 132

10.3.1.1 Rules and Regulations 134

10.3.2 INTELLIGENT PORTABLE MEDICAL DEVICES FUELLING THE MARKET 136

10.3.3 RIGID REGULATORY POLICIES 136

10.4 NORTH AMERICA 137

10.4.1 U.S 139

10.4.1.1 Advanced and well-structured infrastructure and distribution channels 139

10.4.1.2 U.S. has the highest per capita expenditure on healthcare in the world 139

10.4.2 CANADA 140

10.4.2.1 Huge investment toward reducing waiting time of patients 140

10.4.2.2 High healthcare management cost is a challenge in Canada 140

10.4.3 MEXICO 140

10.5 EUROPE 141

10.5.1 U.K. 143

10.5.1.1 Strong focus on research & development activities 143

10.5.1.2 Support from National Health Service(NHS) driving the medical sensors market in the U.K 143

10.5.2 GERMANY 143

10.5.2.1 Germany accounts for the largest spending on healthcare research in the European region 143

10.5.3 FRANCE 144

10.5.3.1 Mergers with multinational companies leading to the growth in the medical sensors market 144

10.5.3.2 Funding for MEMS & nanotechnology encouraging R&D 144

10.5.4 REST OF EUROPE 144

10.6 APAC 146

10.6.1 JAPAN 148

10.6.1.1 Japan: APAC’s fastest-aging nation 148

10.6.2 CHINA 148

10.6.2.1 Presence of a huge population base 148

10.6.3 INDIA 148

10.6.3.1 Rising awareness regarding health and fitness 149

10.6.4 REST OF APAC 149

10.7 REST OF THE WORLD 150

10.7.1.1 RoW: Government efforts for improving accessibility and affordability of the healthcare sector 151

11 COMPETITIVE LANDSCAPE 152

11.1 INTRODUCTION 152

11.2 MARKET RANKING FOR MEDICAL SENSORS MARKET,2014 153

11.3 COMPETITIVE SCENARIO 154

11.3.1 START-UPS SCENARIO 155

11.3.2 TOP DEAL TRENDS 156

11.4 FUNDING OUTLOOK 159

11.5 DEVELOPMENTS 161

11.5.1 NEW PRODUCT LAUNCHES 161

11.5.2 PARTNERSHIPS, AGREEMENTS, & COLLABORATIONS 162

11.5.3 ACQUISITION AND MERGERS 163

12 COMPANY PROFILES 164

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 INTRODUCTION 164

12.2 GE HEALTHCARE 165

12.3 HONEYWELL INTERNATIONAL INC. 169

12.4 STMICROELECTRONICS N.V. 172

12.5 MEASUREMENT SPECIALTIES, INC. 175

12.6 ANALOG DEVICES, INC. 179

12.7 MEDTRONIC PLC 182

12.8 FIRST SENSOR AG 186

12.9 SMITHS MEDICAL 189

12.10 TEXAS INSTRUMENTS 191

12.11 NXP SEMICONDUCTOR N.V. 193

*Details on Overview, Products and Services, Financials, Strategy & Development might not be Captured in case of Unlisted Companies

13 APPENDIX 196

LIST OF TABLES

TABLE 1 MARKET SEGMENTATION: BY APPLICATION 42

TABLE 2 MARKET SEGMENTATION: BY TYPE 43

TABLE 3 MARKET SEGMENTATION : BY PLACEMENT 44

TABLE 4 MARKET SEGMENTATION: BY GEOGRAPHY 45

TABLE 5 GLOBAL MEDICAL SENSOR MARKET SIZE, BY SENSOR TYPE,

2013–2022 (USD MILLION) 72

TABLE 6 GLOBAL MEDICAL SENSOR MARKET SIZE, BY SENSOR TYPE,

2013–2022 (MILLION UNITS) 73

TABLE 7 MEDICAL SENSORS MARKET FOR TEMPERATURE SENSORS, BY APPLICATION, 2013–2022 (USD MILLION) 74

TABLE 8 MEDICAL SENSORS MARKET FOR TEMPERATURE SENSORS, BY APPLICATION, 2013–2022 (MILLION UNITS) 75

TABLE 9 MEDICAL SENSORS MARKET FOR TEMPERATURE SENSORS, BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 75

TABLE 10 MEDICAL SENSORS MARKET FOR TEMPERATURE SENSORS, BY REGION,

2013–2022 (USD MILLION) 76

TABLE 11 MEDICAL SENSORS MARKET FOR BLOOD GLUCOSE SENSORS, BY APPLICATION, 2013–2022 (USD MILLION) 77

TABLE 12 MEDICAL SENSORS MARKET FOR BLOOD GLUCOSE SENSORS, BY APPLICATION, 2013–2022 (MILLION UNITS) 77

TABLE 13 MEDICAL SENSORS MARKET FOR BLOOD GLUCOSE SENSORS, BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 78

TABLE 14 MEDICAL SENSORS MARKET FOR BLOOD GLUCOSE SENSORS, BY REGION,

2013–2022 (USD MILLION) 79

TABLE 15 MEDICAL SENSORS MARKET FOR BLOOD OXYGEN SENSORS, BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 79

TABLE 16 MEDICAL SENSORS MARKET FORBLOOD OXYGEN SENSORS MARKET, BY REGION, 2013–2022 (USD MILLION) 80

TABLE 17 MEDICAL SENSORS MARKET FOR ECG SENSORS, BY APPLICATION,

2013–2022 (USD MILLION) 81

TABLE 18 MEDICAL SENSORS MARKET FOR ECG SENSORS, BY APPLICATION,

2013–2022 (MILLION UNITS) 81

TABLE 19 MEDICAL SENSORS MARKET FOR ECG SENSORS, BY SENSOR PLACEMENT,

2013–2022 (USD MILLION) 82

TABLE 20 MEDICAL SENSORS MARKET FOR IMAGE SENSORS, BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 82

TABLE 21 MEDICAL SENSORS MARKET FOR ECG SENSORS MARKET SIZE, BY REGION, 2013–2022 (USD MILLION) 83

TABLE 22 MEDICAL SENSORS MARKET FOR IMAGE SENSORS, BY APPLICATION,

2013–2022 (USD MILLION) 84

TABLE 23 MEDICAL SENSORS MARKET FOR IMAGE SENSORS, BY APPLICATION,

2013–2022 (MILLION UNITS) 85

TABLE 24 MEDICAL SENSORS MARKET FOR IMAGE SENSORS, BY REGION,

2013–2022 (USD MILLION) 86

TABLE 25 MEDICAL SENSORS MARKET FOR MOTION SENSORS , BY APPLICATION,

2013–2022 (USD MILLION) 87

TABLE 26 MEDICAL SENSORS MARKET FOR MOTION SENSORS , BY APPLICATION,

2013–2022 (MILLION UNITS) 88

TABLE 27 MEDICAL SENSORS MARKET FOR MOTION SENSORS , BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 88

TABLE 28 MEDICAL SENSORS MARKET FOR MOTION SENSORS, BY REGION,

2013–2022 (USD MILLION) 89

TABLE 29 MEDICAL SENSORS MARKET FOR INERTIAL SENSORS , BY APPLICATION,

2013–2022 (USD MILLION) 90

TABLE 30 MEDICAL SENSORS MARKET FOR INERTIAL SENSORS , BY APPLICATION,

2013–2022 (MILLION UNITS) 90

TABLE 31 MEDICAL SENSORS MARKET FOR INERTIAL SENSORS , BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 91

TABLE 32 MEDICAL SENSORS MARKET FOR INERTIAL SENSORS, BY REGION,

2013–2022 (USD MILLION) 91

TABLE 33 MEDICAL SENSORS MARKET FOR PRESSURE SENSORS, BY APPLICATION,

2013–2022 (USD MILLION) 93

TABLE 34 MEDICAL SENSORS MARKET FOR PRESSURE SENSORS , BY APPLICATION,

2013–2022 (MILLION UNITS) 93

TABLE 35 MEDICAL SENSORS MARKET FOR PRESSURE SENSORS , BY SENSOR PLACEMENT, 2013–2022 (USD MILLION) 94

TABLE 36 MEDICAL SENSORS MARKET FOR PRESSURE SENSORS, BY REGION,

2013–2022 (USD MILLION) 95

TABLE 37 MEDICAL SENSOR MARKET SIZE, BY SENSOR PLACEMENT,

2013–2022 (USD MILLION) 99

TABLE 38 MEDICAL SENSORS MARKET FOR STRIP SENSORS, BY SENSOR TYPE,

2013–2022 (USD MILLION) 100

TABLE 39 MEDICAL SENSORS MARKET FOR WEARABLE SENSORS, BY SENSOR TYPE,

2013–2022 (USD MILLION) 102

TABLE 40 MEDICAL SENSORS MARKET FOR IMPLANTABLE SENSORS, BY SENSOR TYPE, 2013–2022 (USD MILLION) 104

TABLE 41 MEDICAL SENSORS MARKET FOR INVASIVE/NON-INVASIVE SENSORS, BY SENSOR TYPE, 2013–2022 (USD MILLION) 106

TABLE 42 MEDICAL SENSORS MARKET FOR INGESTIBLE SENSORS, BY SENSOR TYPE, 2013–2022 (USD MILLION) 107

TABLE 43 MEDICAL SENSOR MARKET SIZE, BY APPLICATION, 2013–2022 (USD MILLION) 110

TABLE 44 MEDICAL SENSOR MARKET SIZE, BY APPLICATION, 2013–2022 (MILLION UNITS) 111

TABLE 45 MEDICAL SENSORS MARKET FOR DIAGNOSTICS APPLICATION, BY SENSOR TYPE, 2013–2022 (USD MILLION) 112

TABLE 46 MEDICAL SENSORS MARKET FOR DIAGNOSTICS APPLICATION, BY SENSOR TYPE, 2013–2022 (MILLION UNITS) 112

TABLE 47 MEDICAL SENSORS MARKET FOR MEDICAL THERAPEUTICS APPLICATION,

BY SENSOR TYPE, 2013–2022 (USD MILLION) 114

TABLE 48 MEDICAL SENSORS MARKET FOR MEDICAL THERAPEUTICS APPLICATION,

BY SENSOR TYPE, 2013–2022 (MILLION UNITS) 115

TABLE 49 MEDICAL SENSORS MARKET FOR MONITORING APPLICATION, BY SENSOR TYPE, 2013–2022 (USD MILLION) 117

TABLE 50 MEDICAL SENSORS MARKET FOR MONITORING APPLICATION, BY SENSOR TYPE, 2013–2022 (MILLION UNITS) 118

TABLE 51 MEDICAL SENSORS MARKET FOR IMAGING APPLICATION, BY TYPE,

2013–2022 (USD MILLION) 122

TABLE 52 MEDICAL SENSORS MARKET FOR IMAGING APPLICATION , BY TYPE,

2013–2022 (MILLION UNITS) 122

TABLE 53 MEDICAL SENSORS MARKET FOR FITNESS AND WELLNESS APPLICATION,

BY SENSOR TYPE, 2013–2022 (USD MILLION) 123

TABLE 54 MEDICAL SENSORS MARKET FOR FITNESS AND WELLNESS APPLICATION,

BY SENSOR TYPE, 2013–2022 (MILLION UNITS) 124

TABLE 55 MEDICAL SENSORS MARKET: PESTEL ANALYSIS 128

TABLE 56 POLITICAL: PESTEL ANALYSIS 128

TABLE 57 ECONOMIC: PESTEL ANALYSIS 129

TABLE 58 SOCIOLOGICAL : PESTEL ANALYSIS 130

TABLE 59 TECHNOLOGICAL: PESTEL ANALYSIS 130

TABLE 60 ENVIRONMENTAL: PESTEL ANALYSIS 131

TABLE 61 LEGAL: PESTEL ANALYSIS 131

TABLE 62 MEDICAL SENSORS: FDA APPROVALS 132

TABLE 63 MEDICAL SENSORS MARKET: RULES AND REGULATIONS 134

TABLE 64 MEDICAL SENSORS MARKET SIZE, BY REGION, 2013–2022 (USD MILLION) 137

TABLE 65 MEDICAL SENSORS MARKET IN NORTH AMERICA, BY COUNTRY

2013–2022 (USD MILLION) 140

TABLE 66 MEDICAL SENSORS MARKET IN NORTH AMERICA, BY SENSOR TYPE,

2013–2022 (USD MILLION) 141

TABLE 67 MEDICAL SENSORS MARKET IN EUROPE, BY COUNTRY 2013–2022 (USD MILLION) 145

TABLE 68 MEDICAL SENSORS MARKET IN EUROPE, BY SENSOR TYPE,

2013–2022 (USD MILLION) 145

TABLE 69 MEDICAL SENSORS MARKET IN APAC, BY COUNTRY 2013–2022 (USD MILLION) 149

TABLE 70 MEDICAL SENSORS MARKET IN JAPAN, BY SENSOR TYPE,

2013–2022 (USD MILLION) 150

TABLE 71 MEDICAL SENSORS MARKET IN ROW, BY SENSOR TYPE,

2013–2022 (USD MILLION) 151

TABLE 72 MARKET RANK ANALYSIS OF THE TOP PLAYERS IN THE MEDICAL SENSOR MARKET, 2014 153

TABLE 73 STARTUP COMPANY GROWTH IN MEDICAL SENSOR 155

TABLE 74 MAJOR DEALS IN THE MEDICAL SENSORS MARKET (2012–2016) 157

TABLE 75 VENTURE FUNDING TRENDS IN MEDICAL SENSOR (2009-2015) 159

TABLE 76 NEW PRODUCT LAUNCHES, 2013–2015 161

TABLE 77 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2013–2015 162

TABLE 78 ACQUISITION & MERGER, 2013–2015 163

TABLE 79 GE HEALTHCARE: KEY FINANCIAL STATEMENT (USD MILLION) 166

TABLE 80 HONEYWELL INTERNATIONAL, INC.: FINANCIAL STATEMENT (USD MILLION) 170

TABLE 81 STMICROELECTRONICS N.V.: FINANCIAL STATEMENT (USD MILLION) 173

TABLE 82 MEASUREMENT SPECIALTIES, INC.: FINANCIAL STATEMENT (USD MILLION) 176

TABLE 83 ANALOG DEVICES, INC.: FINANCIAL STATEMENT (USD MILLION) 180

TABLE 84 MEDTRONIC PLC.: FINANCIAL STATEMENT (USD MILLION) 183

TABLE 85 FIRST SENSOR AG: FINANCIAL STATEMENT (USD MILLION) 187

TABLE 86 SMITHS GROUP PLC: FINANCIAL STATEMENT (USD MILLION) 190

TABLE 87 TEXAS INSTRUMENTS: FINANCIAL STATEMENT (USD MILLION) 192

TABLE 88 NXP SEMICONDUCTOR N.V.: FINANCIAL STATEMENT (USD MILLION) 194

LIST OF FIGURES

FIGURE 1 MEDICAL SENSORS MARKET 17

FIGURE 2 GLOBAL MEDICAL SENSORS MARKET: RESEARCH DESIGN 20

FIGURE 3 RESEARCH METHODOLOGY 24

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 25

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH 26

FIGURE 6 DATA TRIANGULATION : MEDICAL SENSORS 27

FIGURE 7 GLOBAL MEDICAL SENSORS MARKET SIZE BY VALUE AND VOLUME DURING

THE FORECAST PERIOD 29

FIGURE 8 INVASIVE/NON-INVASIVE SENSORS EXPECTED T0 HOLD A MAJOR SHARE OF MEDICAL SENSORS BASED ON PLACEMENT DURING THE FORECAST PERIOD 30

FIGURE 9 INDIA EXPECTED TO GROW AT THE HIGHEST RATE IN THE MEDICAL SENSORS MARKET TILL 2022 31

FIGURE 10 ECG SENSORS GENERATED THE MAXIMUM REVENUE IN THE MEDICAL SENSORS MARKET IN 2015 32

FIGURE 11 REGIONAL SCENARIO OF MEDICAL SENSORS MARKET IN 2015 33

FIGURE 12 ECG SENSORS OF THE MEDICAL SENSORS MARKET HELD THE LARGEST SHARE

IN 2015 34

FIGURE 13 NORTH AMERICA HELD THE LARGEST MARKET SHARE FOLLOWED BY EUROPE DURING 2015 35

FIGURE 14 U.S. HELD THE LARGEST SHARE OF THE MEDICAL SENSORS MARKET IN 2015 36

FIGURE 15 APAC EXPECTED TO WITNESS THE HIGHEST GROWTH RATE FOLLOWED BY EUROPE DURING THE FORECAST PERIOD 37

FIGURE 16 MEDICAL SENSORS MARKET EVOLUTION 40

FIGURE 17 MEDICAL SENSORS MARKET: SEGMENTATION 41

FIGURE 18 INCREASE IN HOSPITAL-ACQUIRED INFECTIONS AND TECHNOLOGICAL ADVANCEMENTS IS DRIVING THE MEDICAL SENSORS MARKET 45

FIGURE 19 PER-CAPITA HEALTHCARE EXPENDITURE IN DIFFERENT COUNTRIES 46

FIGURE 20 OVERALL WEARABLE DEVICE MARKET SIZE BETWEEN 2010 AND 2018 47

FIGURE 21 PERCENTAGE OF POPULATION AGED OVER 65 YEARS IN DIFFERENT COUNTRIES: 2011 AND 2050 48

FIGURE 22 PER CAPITA SPENDING ON HEALTHCARE: DEVELOPED VS. DEVELOPING 50

FIGURE 23 GLOBAL MICROSCOPY DEVICE MARKET SIZE,2011–2018 51

FIGURE 24 GLOBAL HEALTHCARE COLLABORATIONS, M&A TRENDS 52

FIGURE 25 TEMPERATURE SENSOR PRICING TREND 2015 54

FIGURE 26 BLOOD GLUCOSE SENSOR PRICING TREND 2015 55

FIGURE 27 BLOOD OXYGEN SENSOR PRICING TREND 2015 55

FIGURE 28 ECG SENSOR PRICING TREND 2015 56

FIGURE 29 IMAGE SENSOR PRICING TREND 2015 56

FIGURE 30 MOTION SENSOR PRICING TREND 2015 57

FIGURE 31 PRESSURE SENSOR PRICING TREND 2015 57

FIGURE 32 MAJOR VALUE ADDED DURING THE R&D PHASE IN THE MEDICAL SENSORS MARKET 59

FIGURE 33 MEDICAL SENSORS: TECHNOLOGY ROADMAP 60

FIGURE 34 ROADMAP OF TECHNOLOGICAL DEVELOPMENTS IN PERSONAL HEALTHCARE 61

FIGURE 35 INTENSITY OF COMPETITIVE RIVALRY IN THE MARKET WAS ESTIMATED TO HAVE HIGH IMPACT ON THE MEDICAL SENSORS MARKET IN 2015 63

FIGURE 36 MEDICAL SENSORS MARKET: PORTER FIVE FORCES ANALYSIS, 2015 64

FIGURE 37 INTENSITY OF COMPETITIVE RIVALRY EXPECTED TO BE HIGH OWING TO THE GROWTH IN THE NUMBER OF FIRMS 64

FIGURE 38 THREAT OF SUBSTITUTE EXPECTED TO BE LOW OWING TO NON- AVAILABILITY

OF DIRECT SUBSTITUTE FOR SENSORS 65

FIGURE 39 BARGAINING POWER OF BUYERS EXPECTED TO SHOW A MEDIUM IMPACT OWING TO BUYER VOLUME LEVERAGE 66

FIGURE 40 BARGAINING POWER OF SUPPLIERS EXPECTED TO BE MEDIUM OWING

TO INCREASE IN SWITCHING OF SUPPLIER BY BUYER 67

FIGURE 41 THREAT OF NEW ENTRANTS CONSIDERED TO BE MEDIUM OWING TO STRINGENT GOVERNMENT/ REGULATORY ENVIRONMENT 68

FIGURE 42 MEDICAL SENSORS MARKET SEGMENTATION: BY TYPE OF SENSORS 70

FIGURE 43 GLOBAL MEDICAL SENSORS MARKET SIZE, BY TYPE,

2016 VS. 2022 (USD MILLION) 71

FIGURE 44 MEDICAL SENSORS MARKET FOR TEMPERATURE SENSORS, BY REGION,

2016 VS. 2022 (USD MILLION) 76

FIGURE 45 MEDICAL SENSORS MARKET FOR BLOOD GLUCOSE SENSORS, BY REGION,

2016 VS. 2022 (USD MILLION) 78

FIGURE 46 MEDICAL SENSORS MARKET FOR BLOOD OXYGEN SENSORS, BY REGION,

2016 VS. 2022 (USD MILLION) 80

FIGURE 47 MEDICAL SENSORS MARKET FOR ECG SENSORS, BY REGION,

2016 VS. 2022 (USD MILLION) 83

FIGURE 48 MEDICAL SENSORS MARKET FOR IMAGE SENSORS, BY REGION,

2016 VS. 2022 (USD MILLION) 85

FIGURE 49 TYPES OF MOTION SENSORS 87

FIGURE 50 APAC POISED TO WITNESS HIGHEST GROWTH DURING THE FORECAST PERIOD 89

FIGURE 51 INERTIAL SENSORS MARKET SIZE, BY REGION, 2016 VS. 2022 (USD MILLION) 91

FIGURE 52 PRESSURE SENSOR MARKET SIZE, BY REGION, 2016 VS. 2022 (USD MILLION) 94

FIGURE 53 MEDICAL SENSORS MARKET, BY SENSOR PLACEMENT 98

FIGURE 54 GLOBAL MEDICAL SENSORS MARKET, BY SENSOR PLACEMENT

2016 VS. 2022 (USD MILLION) 98

FIGURE 55 STRIP SENSOR MARKET SIZE, BY SENSOR TYPE, 2016 VS. 2022 (USD MILLION) 100

FIGURE 56 WEARABLE SENSOR APPLICATIONS 101

FIGURE 57 WEARABLE SENSOR MARKET SIZE, BY TYPE, 2016 VS. 2022 (USD MILLION) 102

FIGURE 58 IMPLANTABLE SENSOR MARKET, BY TYPE, 2016 VS. 2022 (USD MILLION) 104

FIGURE 59 INVASIVE/NON-INVASIVE SENSOR MARKET SIZE, BY TYPE,

2016 VS. 2022 (USD MILLION) 105

FIGURE 60 INGESTIBLE SENSOR MARKET, BY SENSOR TYPE, 2016 VS. 2022 (USD MILLION) 107

FIGURE 61 GLOBAL MEDICAL SENSORS MARKET SIZE, BY APPLICATION,

2016 VS. 2022 (USD MILLION) 110

FIGURE 62 DIAGNOSTICS APPLICATION MARKET SIZE, BY TYPE,

2016 VS. 2022 (USD MILLION) 111

FIGURE 63 MEDICAL THERAPEUTICS APPLICATION MARKET SIZE, BY TYPE,

2016 VS. 2022 (USD MILLION) 114

FIGURE 64 MONITORING APPLICATION MARKET SIZE, BY TYPE, 2016 VS. 2022 (USD MILLION) 117

FIGURE 65 GLOBAL DIABETES POPULATION TREND 2014 VS 2035 120

FIGURE 66 IMAGING APPLICATION MARKET SIZE, BY TYPE, 2016 VS. 2022 (USD MILLION) 121

FIGURE 67 FITNESS AND WELLNESS APPLICATION MARKET SIZE, BY TYPE,

2016 VS. 2022 (USD MILLION) 123

FIGURE 68 MEDICAL SENSORS MARKET: GEOGRAPHIC SNAPSHOT 127

FIGURE 69 FRAMEWORK OF MEDICAL DEVICE REGULATIONS 135

FIGURE 70 MEDICAL SENSORS MARKET: COUNTRY-WISE GROWTH (2016–2022) 136

FIGURE 71 NORTH AMERICA: MEDICAL SENSORS MARKET SEGMENTATION 137

FIGURE 72 NORTH AMERICA: MARKET SNAPSHOT 138

FIGURE 73 EUROPE: MEDICAL SENSORS MARKET SEGMENTATION 141

FIGURE 74 EUROPE: MARKET SNAPSHOT 142

FIGURE 75 MEDICAL SENSORS MARKET SEGMENTATION: APAC 146

FIGURE 76 APAC: MARKET SNAPSHOT 147

FIGURE 77 ROW: MEDICAL SENSORS MARKET SEGMENTATION 150

FIGURE 78 COMPANIES ADOPTED PRODUCT INNOVATION AS THE KEY GROWTH STRATEGY DURING 2012-2014 152

FIGURE 79 MARKET EVALUATION FRAMEWORK—NEW PRODUCT LAUNCHES DRIVE GROWTH AND INNOVATION BETWEEN 2013 AND 2015 154

FIGURE 80 TRENDS OF DEALS IN MEDICAL SENSORS MARKET (2012–2015) 156

FIGURE 81 NEW PRODUCT LAUNCHES WAS THE KEY STRATEGY IN THE BATTLE OF THE MARKET SHARE 160

FIGURE 82 GEOGRAPHIC REVENUE MIX OF THE TOP 5 MARKET PLAYERS 164

FIGURE 83 GE HEALTHCARE: COMPANY SNAPSHOT 165

FIGURE 84 GE HEALTHCARE: SWOT ANALYSIS 168

FIGURE 85 HONEYWELL INTERNATIONAL, INC. : COMPANY SNAPSHOT 169

FIGURE 86 HONEYWELL INTERNATIONAL, INC.: SWOT ANALYSIS 171

FIGURE 87 STMICROELECTRONICS N.V. : COMPANY SNAPSHOT 172

FIGURE 88 STMICROELECTRONICS N.V.: SWOT ANALYSIS 174

FIGURE 89 MEASUREMENT SPECIALITIES, INC.: COMPANY SNAPSHOT 175

FIGURE 90 MEASUREMENT SPECIALTIES, INC. : SWOT ANALYSIS 178

FIGURE 91 ANALOG DEVICES, INC.: COMPANY SNAPSHOT 179

FIGURE 92 ANALOG DEVICES, INC. :SWOT ANALYSIS 181

FIGURE 93 MEDTRONIC PLC: COMPANY SNAPSHOT 182

FIGURE 94 MEDTRONIC PLC: SWOT ANALYSIS 185

FIGURE 95 FIRST SENSOR, AG: COMPANY SNAPSHOT 186

FIGURE 96 SMITHS GROUP PLC: COMPANY SNAPSHOT 189

FIGURE 97 TEXAS INSTRUMENTS: COMPANY SNAPSHOT 191

FIGURE 98 NXP SEMICONDUCTOR N.V.: COMPANY SNAPSHOT 193

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

モバイルヘルス・ソリューションの世界市場:デバイス、アプリ、サービス別2020年市場予測

モバイルヘルス・ソリューションの世界市場:デバイス、アプリ、サービス別2020年市場予測

お問合わせはこちらから

お問合わせはこちらから