自動車用燃料タンクの世界市場:容量別、マテリアル別2021年予測

Fuel Tank Market by Material (HDPE, Steel & Aluminum), Capacity (<45L, 45L-70L & >70L), & by Region (Asia-Oceania, Europe, North America & ROW), Automotive CNG Tank Market by Region, and Automotive SCR Market by Region - Global Trends & Forecast to 2021

- 出版元:MarketsandMarkets(米国)

出版元について

出版元について - 発行年:2016年7月

- 定価 Single User License(1名様ライセンス)US$5,650(米国ドル)/Multi User License(5名様)$6,650 /Corporate User License $8,150

- ご予算に応じた各種ご提案も承ります。詳細はお問い合わせください。

- ご請求は円換算(お見積り日TTSレート)となります。

- 納品形態:PDF by Email

- 当調査レポートは英文163ページになります。

- 商品コード:MAM284

お問い合わせ、お見積りのリクエストは下のボタンをクリックしてご入力ください。

【レポート紹介】

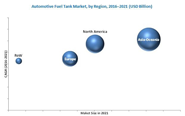

自動車用燃料タンクの今後2021年における世界市場規模は173億ドルと、当レポートでは予測しています。軽量化と低コストなどの利点を有するHDPEタンクは高成長率が期待されます。

レポートでは、2021年に至る自動車用燃料タンクの世界市場予測(金額US$, ユニット数)、マテリアル別タンク市場(HDPE、スチール、アルミ)、タンク容量別市場(45L未満、45-70L、70L超)、主要国地域別市場、SCR(選択的触媒還元脱硝装置)市場、圧縮天然ガス自動車用タンク市場など、詳細に細分化された市場予測データと動向を掲載しています。またサプライチェーン、市場シェア分析、競合、燃料タンクの主要メーカー企業10社動向などの調査も盛り込み、自動車用燃料タンク市場のこの先の展望と市場機会を検討していきます。

【レポート構成概要】

◆自動車用燃料タンクの世界市場予測2014-2021年

・市場規模(US$)

・ユニット数(units)

◆マテリアル別、自動車燃料タンク市場-2021年予測と動向(市場規模、ユニット数)

・HDPE(高密度ポリエチレン)

・鋼鉄(スチール)

・アルミニウム

◆タンク容量別、市場予測-2021と動向(市場規模、ユニット数)

・45L未満

・45L~70L

・70L超

◆主要国地域別市場-2021年予測と分析

アジアオセアニア

・日本、中国、韓国、インド

・その他アジアオセアニア

北米

・米国、カナダ、メキシコ

欧州

・ドイツ、フランス、英国、スペイン、ロシア

・その他欧州

その他地域(Rest of the World)

・ブラジル、南アフリカ

・その他諸国

◆選択的触媒還元脱硝装置(SCR: Selective Catalytic Reduction)市場

・地域別

・搭載車種別

(市場規模、ユニット数)

◆CNGV(圧縮天然ガス自動車)用タンク市場

・地域別

(市場規模、ユニット数)

◆市場分析、競合

・市場ダイナミクス(促進要因、阻害要因、機会、課題)

・サプライチェーン分析(需給関係)

・競合分析モデル(ファイブフォース分析)

・市場シェア分析

◆自動車用燃料タンクの主要メーカー企業10社動向

・THE PLASTIC OMNIUM GROUP

・八千代工業株式会社

・ユニプレス株式会社

・MAGNA INTERNATIONAL INC.

・MARTINREA INTERNATIONAL INC.

・KAUTEX TEXTRON GMBH & CO. KG.

・YAPP AUTOMOTIVE PARTS CO., LTD.

・TI AUTOMOTIVE INC.

・FTS CO., LTD.

・SMA SERBATOI S.P.A.

【レポート詳細目次、データ項目一覧は当ページ下を参照ください】

英文詳細目次(table of contents)

【原文詳細目次】

Fuel Tank Market by Material (HDPE, Steel & Aluminum), Capacity (<45L, 45L-70L & >70L), & by Region (Asia-Oceania, Europe, North America & ROW), Automotive CNG Tank Market by Region, and Automotive SCR Market by Region - Global Trends & Forecast to 2021

Table of Contents

1 INTRODUCTION 14

1.1 OBJECTIVES OF THE STUDY 14

1.2 MARKET DEFINITION 14

1.3 MARKET SCOPE 15

1.3.1 MARKETS COVERED 15

1.3.2 YEARS CONSIDERED IN THE REPORT 16

1.4 CURRENCY 17

1.5 PACKAGE SIZE 17

1.6 LIMITATIONS 17

1.7 STAKEHOLDERS 17

2 RESEARCH METHODOLOGY 18

2.1 RESEARCH DATA 18

2.2 SECONDARY DATA 19

2.2.1 KEY SECONDARY SOURCES 19

2.3 DATA FROM SECONDARY SOURCES 20

2.4 PRIMARY DATA 21

2.4.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS 21

2.4.2 PRIMARY PARTICIPANTS 22

2.5 FACTOR ANALYSIS 22

2.5.1 INTRODUCTION 22

2.5.2 DEMAND-SIDE ANALYSIS 23

2.5.2.1 Impact of Disposable Income on Total Vehicle Sales 23

2.5.2.2 Infrastructure: Roadways 24

2.5.3 SUPPLY-SIDE ANALYSIS 25

2.5.3.1 Government Regulations Pertaining to Vehicle Emissions 25

2.6 MARKET SIZE ESTIMATION 25

2.7 DATA TRIANGULATION 27

2.8 ASSUMPTIONS 28

3 EXECUTIVE SUMMARY 29

3.1 INTRODUCTION 29

4 PREMIUM INSIGHTS 34

4.1 ATTRACTIVE OPPORTUNITIES IN THE AUTOMOTIVE FUEL TANK MARKET 34

4.2 HDPE FUEL TANK SEGMENT TO LEAD THE GLOBAL AUTOMOTIVE FUEL TANK MARKET

IN 2016 35

4.3 REGIONAL MARKET SHARE OF THE AUTOMOTIVE FUEL TANK MARKET, 2016 36

4.4 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL TYPE 37

4.5 AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 37

4.6 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION MARKET, BY REGION 38

4.7 AUTOMOTIVE COMPRESSED NATURAL GAS MARKET, BY REGION 38

5 MARKET OVERVIEW 39

5.1 INTRODUCTION 40

5.2 MARKET SEGMENTATION 40

5.2.1 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL 41

5.2.2 AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 41

5.2.3 AUTOMOTIVE FUEL TANK MARKET, BY REGION 42

5.2.4 AUTOMOTIVE SCR MARKET, BY REGION 42

5.2.5 AUTOMOTIVE CNG TANK MARKET, BY REGION 43

5.3 MARKET DYNAMICS 43

5.3.1 DRIVERS 44

5.3.1.1 Increasing Vehicle Production 44

5.3.1.2 Rising Demand for Lightweight Components to fuel the demand

for plastic fuel tanks 45

5.3.2 RESTRAINTS 46

5.3.2.1 Shifting Focus Towards Electric Vehicles 46

5.3.2.2 Stringent Evaporative Emission Standards 47

5.3.3 OPPORTUNITIES 47

5.3.3.1 Carbon Fibre Fuel Tanks 47

5.3.4 CHALLENGES 47

5.3.4.1 Recycling of the Plastic Fuel Tanks 47

5.4 PORTER’S FIVE FORCES ANALYSIS 48

5.4.1 INTENSITY OF COMPETITIVE RIVALRY 49

5.4.2 THREAT OF SUBSTITUTE 50

5.4.3 BARGAINING POWER OF BUYERS 51

5.4.4 BARGAINING POWER OF SUPPLIERS 52

5.4.5 THREAT OF NEW ENTRANT 53

5.5 FUEL TANK SUPPLY CHAIN ANALYSIS 54

5.5.1 FUEL TANK - WHO SUPPLIES WHOM 55

5.5.1.1 Asia-Oceania 55

5.5.1.2 Europe 68

5.5.1.3 Americas 72

6 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL 76

6.1 INTRODUCTION 77

6.2 HDPE FUEL TANK MARKET, BY REGION 78

6.3 STEEL FUEL TANK MARKET, BY REGION 79

6.4 ALUMINUM FUEL TANK MARKET, BY REGION 80

7 AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY & REGION 82

7.1 INTRODUCTION 83

7.2 ASIA-OCEANIA 85

7.2.1 CHINA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 89

7.2.2 JAPAN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 90

7.2.3 SOUTH KOREA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 91

7.2.4 INDIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 92

7.2.5 REST OF ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 93

7.3 NORTH AMERICA 94

7.3.1 THE U.S.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 97

7.3.2 MEXICO: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 98

7.3.3 CANADA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 99

7.4 EUROPE 100

7.4.1 GERMANY: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 102

7.4.2 FRANCE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 103

7.4.3 U.K.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 104

7.4.4 SPAIN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 105

7.4.5 RUSSIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 106

7.4.6 REST OF EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 107

7.5 REST OF THE WORLD 108

7.5.1 BRAZIL: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 110

7.5.2 SOUTH AFRICA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 111

7.5.3 ROW OTHERS: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 112

8 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION MARKET,

BY VEHICLE TYPE & REGION 113

8.1 INTRODUCTION 114

8.2 GLOBAL AUTOMOTIVE SCR MARKET, BY REGION 115

8.2.1 ASIA-OCEANIA AUTOMOTIVE SCR MARKET, BY VEHICLE TYPE 116

8.2.2 NORTH AMERICA AUTOMOTIVE SCR MARKET, BY VEHICLE TYPE 117

8.2.3 EUROPE AUTOMOTIVE SCR MARKET, BY VEHICLE TYPE 118

8.2.4 ROW AUTOMOTIVE SCR MARKET, BY VEHICLE TYPE 119

9 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET, BY REGION 120

9.1 INTRODUCTION 121

9.2 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET, BY REGION 122

10 COMPETITIVE LANDSCAPE 123

10.1 MARKET SHARE ANALYSIS 124

10.2 COMPETITIVE SITUATIONS & TRENDS 125

10.3 EXPANSION 126

10.4 AGREEMENTS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS 127

10.5 NEW PRODUCT LAUNCH 128

10.6 MERGERS & ACQUISITIONS 129

11 COMPANY PROFILES 130

(Company at a Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MNM View)*

11.1 INTRODUCTION 130

11.2 THE PLASTIC OMNIUM GROUP 131

11.3 YACHIYO INDUSTRY CO. LTD. 134

11.4 UNIPRES CORPORATION 137

11.5 MAGNA INTERNATIONAL INC. 140

11.6 MARTINREA INTERNATIONAL INC. 143

11.7 KAUTEX TEXTRON GMBH & CO. KG. 146

11.8 YAPP AUTOMOTIVE PARTS CO., LTD. 147

11.9 TI AUTOMOTIVE INC. 148

11.10 FTS CO., LTD. 150

11.11 SMA SERBATOI S.P.A. 151

*Details on company at a glance, recent financials, Products offered, strategies & insights, & recent developments might not be captured in case of unlisted companies.

12 APPENDIX 152

LIST OF TABLES

TABLE 1 VARIOUS GOVERNMENT INCENTIVES FOR ELECTRIC VEHICLES 46

TABLE 2 PORTERS FIVE FORCES ANALYSIS 49

TABLE 3 ASIA-OCEANIA: WHO SUPPLIES WHOM 55

TABLE 4 EUROPE: WHO SUPPLIES WHOM 68

TABLE 5 AMERICAS: WHO SUPPLIES WHOM 72

TABLE 6 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL, 2014–2021 (‘000 UNITS) 77

TABLE 7 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL, 2014–2021 (METRIC TONS) 78

TABLE 8 HIGH-DENSITY POLYETHYLENE FUEL TANK MARKET, BY REGION,

2014–2021 (‘000 UNITS) 78

TABLE 9 HIGH-DENSITY POLYETHYLENE FUEL TANK MARKET, BY REGION,

2014–2021 (METRIC TONS) 79

TABLE 10 STEEL FUEL TANK MARKET, BY REGION, 2014–2021 (‘000 UNITS) 79

TABLE 11 STEEL FUEL TANK MARKET, BY REGION, 2014–2021 (METRIC TONS) 80

TABLE 12 ALUMINUM FUEL TANK MARKET, BY REGION, 2014–2021 (‘000 UNITS) 80

TABLE 13 ALUMINUM FUEL TANK MARKET, BY REGION, 2014–2021 (METRIC TONS) 81

TABLE 14 GLOBAL AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 84

TABLE 15 GLOBAL AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 84

TABLE 16 GLOBAL AUTOMOTIVE FUEL TANK MARKET, BY REGION, 2014–2021 (‘000 UNITS) 84

TABLE 17 GLOBAL AUTOMOTIVE FUEL TANK MARKET, BY REGION, 2014–2021 (USD MILLION) 85

TABLE 18 ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 87

TABLE 19 ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 87

TABLE 20 ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (‘000 UNITS) 88

TABLE 21 ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (USD MILLION) 88

TABLE 22 CHINA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 89

TABLE 23 CHINA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 89

TABLE 24 JAPAN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 90

TABLE 25 JAPAN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 90

TABLE 26 SOUTH KOREA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 91

TABLE 27 SOUTH KOREA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 91

TABLE 28 INDIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 92

TABLE 29 INDIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 92

TABLE 30 REST OF ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 93

TABLE 31 REST OF ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 93

TABLE 32 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 95

TABLE 33 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 95

TABLE 34 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (‘000 UNITS) 96

TABLE 35 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (USD MILLION) 96

TABLE 36 U.S.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 97

TABLE 37 U.S.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 97

TABLE 38 MEXICO: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 98

TABLE 39 MEXICO: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 98

TABLE 40 CANADA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 99

TABLE 41 CANADA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 99

TABLE 42 EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 100

TABLE 43 EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 100

TABLE 44 EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY, 2014–2021 (‘000 UNITS) 101

TABLE 45 EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (USD MILLION) 101

TABLE 46 GERMANY: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 102

TABLE 47 GERMANY: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 102

TABLE 48 FRANCE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 103

TABLE 49 FRANCE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 103

TABLE 50 U.K.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 104

TABLE 51 U.K.: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 104

TABLE 52 SPAIN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 105

TABLE 53 SPAIN: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (USD MILLION) 105

TABLE 54 RUSSIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 106

TABLE 55 RUSSIA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 106

TABLE 56 REST OF EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 107

TABLE 57 REST OF EUROPE: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 107

TABLE 58 REST OF THE WORLD: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 108

TABLE 59 REST OF THE WORLD: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 108

TABLE 60 REST OF THE WORLD: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (‘000 UNITS) 109

TABLE 61 REST OF THE WORLD: AUTOMOTIVE FUEL TANK MARKET, BY COUNTRY,

2014–2021 (USD MILLION) 109

TABLE 62 BRAZIL: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 110

TABLE 63 BRAZIL: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 110

TABLE 64 SOUTH AFRICA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (‘000 UNITS) 111

TABLE 65 SOUTH AFRICA: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 111

TABLE 66 OTHERS: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY, 2014–2021 (‘000 UNITS) 112

TABLE 67 OTHERS: AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY,

2014–2021 (USD MILLION) 112

TABLE 68 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION MARKET, BY REGION,

2014–2021 (‘000 UNITS) 115

TABLE 69 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION MARKET, BY REGION,

2014–2021 (USD MILLION) 115

TABLE 70 ASIA-OCEANIA: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE, 2014–2021 (‘000 UNITS) 116

TABLE 71 ASIA-OCEANIA: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE, 2014–2021 (USD MILLION) 116

TABLE 72 NORTH AMERICA: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE, 2014–2021 (‘000 UNITS) 117

TABLE 73 NORTH AMERICA: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE, 2014–2021 (USD MILLION) 117

TABLE 74 EUROPE: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE,

2014–2021 (‘000 UNITS) 118

TABLE 75 EUROPE: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE,

2014–2021 (USD MILLION) 118

TABLE 76 ROW: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE,

2014–2021 (‘000 UNITS) 119

TABLE 77 ROW: SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE,

2014–2021 (USD MILLION) 119

TABLE 78 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET, BY REGION,

2014–2021 (UNITS) 122

TABLE 79 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET, BY REGION,

2014–2021 (USD MILLION) 122

TABLE 80 FUEL TANK MARKET: MARKET RANKING 125

TABLE 81 EXPANSIONS, 2015–2016 126

TABLE 82 AGREEMENTS/JOINT VENTURES/PARTNERSHIPS, 2012 - 2014 127

TABLE 83 NEW PRODUCT LAUNCHES, 2013-2015 128

TABLE 84 MERGERS & ACQUISITIONS, 2014–2015 129

LIST OF FIGURES

FIGURE 1 AUTOMOTIVE FUEL TANK MARKET SEGMENTATION 15

FIGURE 2 GLOBAL SELECTIVE CATALYTIC REDUCTION MARKET SEGMENTATION 16

FIGURE 3 GLOBAL COMPRESSED NATURAL GAS TANK MARKET SEGMENTATION 16

FIGURE 4 RESEARCH DESIGN 18

FIGURE 5 RESEARCH METHODOLOGY MODEL 19

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION,

& REGION 21

FIGURE 7 IMPACT OF DISPOSABLE INCOME ON VEHICLE SALES, 2014 23

FIGURE 8 ROADWAYS INFRASTRUCTURE: ROAD NETWORK (KM), BY COUNTRY, 2011 24

FIGURE 9 AUTOMOTIVE FUEL TANK MARKET: BOTTOM-UP APPROACH 26

FIGURE 10 ASIA-OCEANIA IS ESTIMATED TO BE THE LARGEST MARKET FOR AUTOMOTIVE FUEL TANKS, 2016 VS. 2021 (USD BILLION) 30

FIGURE 11 45 L–70 L CAPACITY SEGMENT TO DOMINATE THE AUTOMOTIVE FUEL TANK MARKET, IN 2016 31

FIGURE 12 HDPE HOLDS THE LARGEST SHARE IN THE AUTOMOTIVE FUEL TANK MARKET,

BY MATERIAL, 2016 (METRIC TONS) 31

FIGURE 13 EUROPE IS ESTIMATED TO BE THE LARGEST MARKET FOR SELECTIVE CATALYTIC REDUCTION 2016 VS. 2021 32

FIGURE 14 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET, BY REGION,

2016 VS. 2021 (USD MILLION) 33

FIGURE 15 RISING VEHICLE PRODUCTION TO DRIVE THE DEMAND FOR AUTOMOTIVE FUEL TANK MARKET FROM 2016 TO 2021 34

FIGURE 16 AUTOMOTIVE FUEL TANK MARKET SHARE, BY MATERIAL & REGION, 2016 35

FIGURE 17 ASIA-OCEANIA HOLDS THE LARGEST MARKET SHARE, BY VALUE, 2016–2021 36

FIGURE 18 HDPE FUEL TANK SEGMENT TO LEAD THE GLOBAL AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL, 2016 VS. 2021 37

FIGURE 19 45 L–70 L FUEL TANK SEGMENT TO LEAD THE MARKET, 2016–2021 37

FIGURE 20 EUROPE IS ESTIMATED TO DOMINATE THE SELECTIVE CATALYTIC REDUCTION MARKET BY VALUE, 2016–2021 38

FIGURE 21 REST OF THE WORLD TO HOLD THE LARGEST MARKET BY VALUE, 2016–2021 38

FIGURE 22 AUTOMOTIVE FUEL TANK: MARKET SEGMENTATION 40

FIGURE 23 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL 41

FIGURE 24 AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY 41

FIGURE 25 AUTOMOTIVE FUEL TANK MARKET, BY REGION 42

FIGURE 26 AUTOMOTIVE SCR MARKET, BY REGION 42

FIGURE 27 AUTOMOTIVE CNG TANK MARKET, BY REGION 43

FIGURE 28 AUTOMOTIVE FUEL TANK MARKET DYNAMICS 44

FIGURE 29 INCREASE IN VEHICLE PRODUCTION ACROSS THE GLOBE, 2009 VS 2015 45

FIGURE 30 ELECTRIC VEHICLE SALES, 2015 VS 2020 46

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS 48

FIGURE 32 HIGH BARGAINING POWER OF BUYERS AND THREAT OF NEW ENTRANTS 48

FIGURE 33 LARGE NUMBER OF ESTABLISHED PLAYERS LEADS TO HIGH DEGREE OF COMPETITION IN THE AUTOMOTIVE FUEL TANK MARKET 49

FIGURE 34 HIGH COST MAKES THE THREAT OF SUBSTITUTE MEDIUM 50

FIGURE 35 AVAILABILITY OF LARGE NUMBER OF SUPPLIERS LEADS TO HIGH BARGAINING POWER OF BUYERS 51

FIGURE 36 DEPENDENCE ON THE AUTOMOTIVE INDUSTRY AND LOW PRODUCT DIFFERENTIATION MAKES BARGAINING POWER OF SUPPLIERS LOW 52

FIGURE 37 LOW CAPITAL INVESTMENT LEADS TO HIGH THREAT OF NEW ENTRANT 53

FIGURE 38 SUPPLY CHAIN ANALYSIS 54

FIGURE 39 HIGH-DENSITY POLYETHYLENE ESTIMATED TO BE THE MOST WIDELY USED MATERIAL FOR AUTOMOTIVE FUEL TANKS 77

FIGURE 40 AUTOMOTIVE FUEL TANK MARKET OUTLOOK, BY COUNTRY, 2016–2021 83

FIGURE 41 ASIA-OCEANIA: AUTOMOTIVE FUEL TANK MARKET SNAPSHOT 86

FIGURE 42 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET SNAPSHOT 94

FIGURE 43 GLOBAL SELECTIVE CATALYTIC REDUCTION MARKET, BY REGION,

2016–2021 (USD BILLION) 114

FIGURE 44 AUTOMOTIVE COMPRESSED NATURAL GAS TANK MARKET,

2016 VS. 2021 (USD MILLION) 121

FIGURE 45 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY 123

FIGURE 46 MARTINREA INTERNATIONAL INC. REGISTERED THE HIGHEST GROWTH RATE FROM 2011 TO 2015 124

FIGURE 47 PLASTIC FUEL TANK OE MARKET: MARKET SHARE ANALYSIS 124

FIGURE 48 MARKET EVALUATION FRAMEWORK: EXPANSIONS FUELLED THE GROWTH OF THE FUEL TANK MARKET 125

FIGURE 49 BATTLE FOR MARKET SHARE: EXPANSION WAS THE MOST WIDELY ADOPTED STRATEGY 126

FIGURE 50 REGION-WISE REVENUE MIX OF FUEL TANK SUPPLIERS, 2015 130

FIGURE 51 THE PLASTIC OMNIUM GROUP: COMPANY SNAPSHOT 131

FIGURE 52 SWOT ANALYSIS: THE PLASTIC OMNIUM GROUP 133

FIGURE 53 YACHIYO INDUSTRY CO. LTD.: COMPANY SNAPSHOT 134

FIGURE 54 SWOT ANALYSIS: YACHIYO INDUSTRY CO. LTD. 136

FIGURE 55 UNIPRES CORPORATION: COMPANY SNAPSHOT 137

FIGURE 56 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT 140

FIGURE 57 SWOT ANALYSIS: MAGNA INTERNATIONAL INC. 142

FIGURE 58 MARTINREA INTERNATIONAL INC.: COMPANY SNAPSHOT 143

FIGURE 59 SWOT ANALYSIS: MARTINREA INTERNATIONAL INC. 145

プレスリリース

プレスリリース

当レポートのプレスリリースは発行されておりません。

当レポートのプレスリリースは発行されておりません。

HOME

HOME

自動車ガソリンエンジンの世界市場2016-2026年:ダウンサイジング、ターボチャージャー搭載の展望

自動車ガソリンエンジンの世界市場2016-2026年:ダウンサイジング、ターボチャージャー搭載の展望 お問合わせはこちらから

お問合わせはこちらから